Corporate innovation is changing in form and process

Posted on

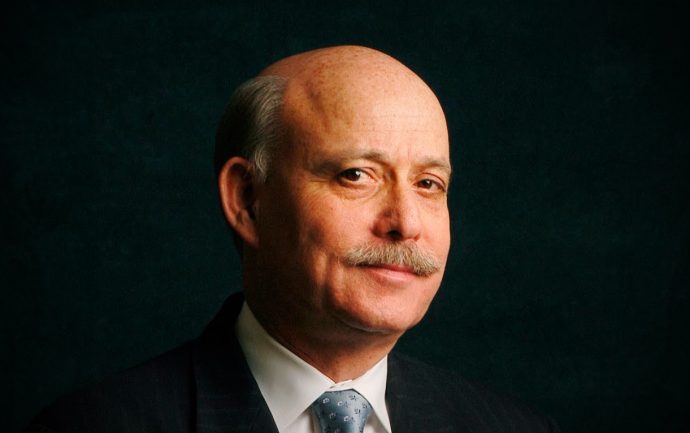

How to innovate in large companies? This simple question turns out to be much more complex than expected, as global players are focused on executing a proven business model rather than searching for a new one whose profitability is untested. These are some of the issues that Andreas Page, Senior Manager in charge of Digital Business Development at Swisscom and myself discussed recently. Presentation…