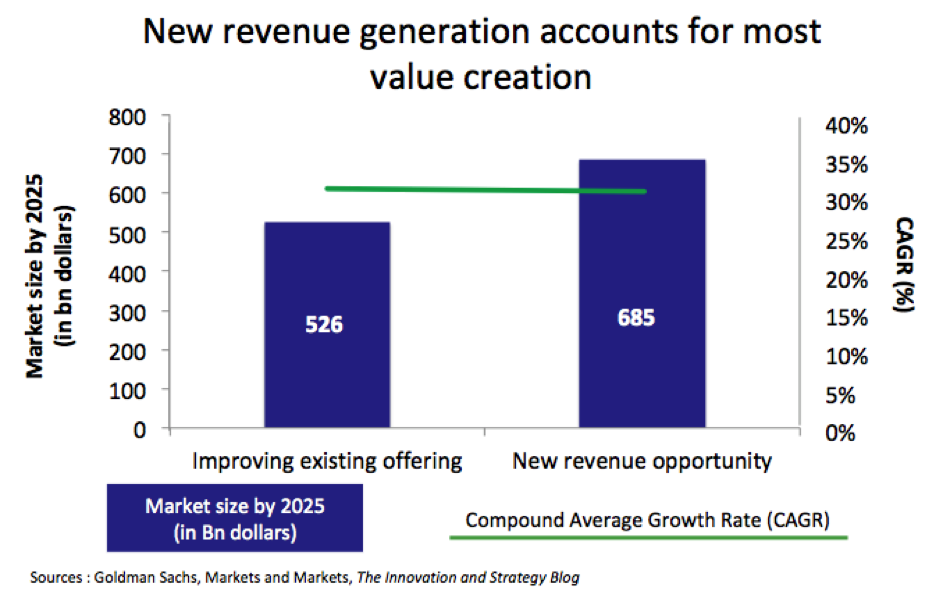

What makes up the $1210 value creation? How to grasp the implications for Senior Leaders and investors in digital technology? Quantitative analysis shows that new revenue generation should claim the largest share of the $1210 Bn at stake, ahead of existing offerings improvement.

Most value to come from novel business lines

Top management may consider several alternatives if they want to tap into the $1210 billion pool.

I/ Betting on current activities to claim $526 Bn in value at 31% CAGR

First of all, they could look into enhancing existing offerings by incorporating novel technologies in their product lines. $526 billion are at stake. C-level executives may tackle the following issues:

- Which segments in the value chain should we focus on: inbound logistics, operations, outbound logistic, marketing, sales and distribution?

- Which technology seems instrumental in deepening our understanding of our client’s decision-making process? How could it provide us insights in figuring out why our customers are willing to pay us? And what could we design to tap into a higher share?

- What could make the largest impact across our production chain: Artificial Intelligence, Industry of the Future, Virtual and Augmented Reality, Blockchain, Cybersecurity, Drones?

- Which “use cases” (defined here as a technology applied to a business problem) appear most prevalent across our organization?

- How should we go about developing capabilities to address relevant use cases: build or buy?

- What’s competition doing? Where are they putting their money?

- Which partner is tackling issues that most resonate with ours?

II/ Going for new business $685 Bn in value at 31% CAGR

Second of all, established players must design an innovation engine. $685 billion are out for grabs. Senior Leaders may consider the following:

- How much do we want to claim out of the $685 billion? Why?

- What use cases seem most promising in terms of market value and CAGR?

- Do we have the right folks? Is our corporate culture tolerant to failure? Who do we have in our team that has demonstrated appropriate competencies?

- Is our company able to take on uncertain, high-risk projects?

- What technologies have we produced that sets us apart?

- How do assets (people, organizational agility, sales know-how…) prove critical to capturing a slice of the $685 billion?

Engineering relevant capabilities involves:

- building startup studios,

- financing open innovation programs,

- growing talent,

- partnering with VC to acquire and/or support startups,

- launching research and development plans universities,

- engaging with current accounts in a novel way by uncovering fresh topics in their value chain.

Though venturing in white spaces seems risky, shareholders reward forward-looking companies with higher Earnings Per Share (EPS), according to Luka Mucic, CFO of SAP.

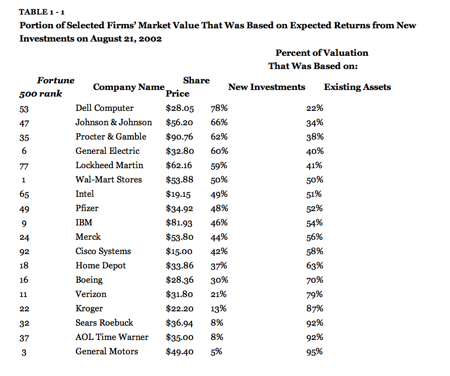

Harvard Professor and disruptive innovation guru, Clayton Christensen quoted Deloitte who compared valuations based on whether it reflected existing assets or new investments, as indicated below :

Results show R&D-intensies companies like pharmaceuticals and technology players buid their value on investment when traditional second industrial revolution companies (automotive, aviation…) rely on current assets.

Again, this proves that innovation investment carries implications on a company’s valuation.

III/ Getting a piece of both to claim $1210 Bn in value

Finally, the more profound questions arise when ambitious established companies target at taking a share in both segments: improving existing offerings and generating new revenue. $1210 billion are at stake. In this case, they must undergo a “dual transformation” and consider the following:

- Is our organization agile enough to overhaul operations and bet on high-risk projects, at the same time?

- Have we developed a corporate culture that combines process optimization rigor and creativity necessary to building futuristic products?

- Have we a set up a resource allocation framework that allows for both innovation and improvement?

- Are we able to run 2 distinct business models, with different cost structures, value proposition and margins?

- How do we support both projects that provide short term Return On Investment (in the case of operational excellence) and those with long-term ROI (3 to 5 years) for ventures?

Finding solutions to questions above proves critical to established companies in a time when Silicon Valley startups and Chinese unicorns are challenging incumbents in many industries on global scale. For example, energy management leader, Schneider Electric is evolving from a “product-centric” to “product + service business model” to help its clients boost energy efficiency all along their production chain, according to a conversation I had with Nicolas Leterrier, Chief Technology Officer at Schneider. Effecting such a transformation implies acquiring over 30 startups a year to integrate key assets (competencies, digital technology (IoT, AI, Cybersecurity…) and talent) and make it happen.

On a broader level, second-Industrial-Revolution-born-corporations, like GE, BT, EDF, Fujitsu, Ford Motors, GSK, L’Oréal, Walmart, AT&T, Exxon Mobil and Total that address these issues will prosper as the Third Industrial Revolution unfolds; those that don’t will go bust, according to Jeremy Rifkin, author of The Zero Marginal Cost Society.

In a follow-up article, we’ll look at 7 technologies and assess their market value creation potential and CAGR by 2025.

No comment