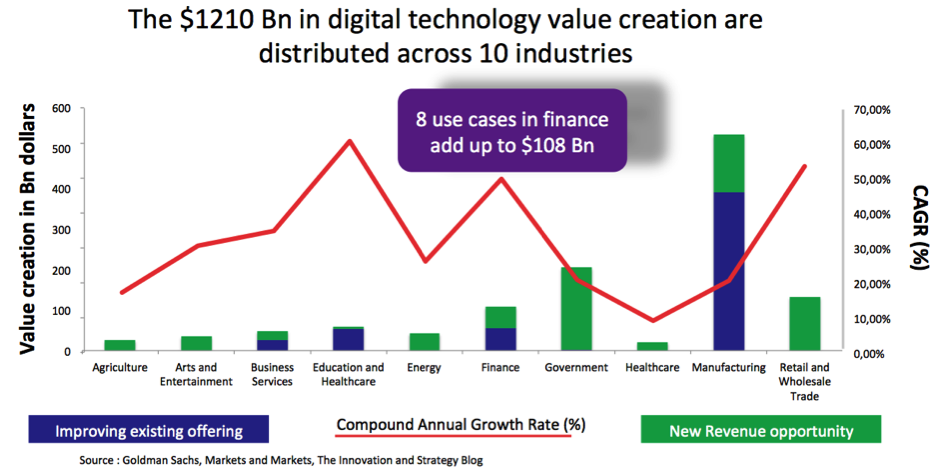

As digital technologies should pave the way to $1210 billion in value by 2025, bankers will be playing a dual role. First of all, they will be investing across many industries in order to optimize production chains and increase overall capital efficiency. Second of all, they’ll be revamping their own business as the financial sector should generate $108 Bn in value by 2025. But where should they focus their energy? What stand as the strongest opportunities? I addressed some of these questions in a recent keynote to 50 executives in global bank based in Paris.

Which use cases seems most promising in the? Where should Senior Executives invest their time and energy? What’s the potential for value creation in next few years? These questions prove crucial to:

- Established banks companies trying to stay ahead of fintech-startups-soon-to-be-global competitors,

- Digital players like Accenture, Fujitsu and IBM seeking to develop strong industrial expertise,

- Google, Apple, Facebook, Microsoft and Amazon looking to find new markets in the financial sector where data appears so prevalent,

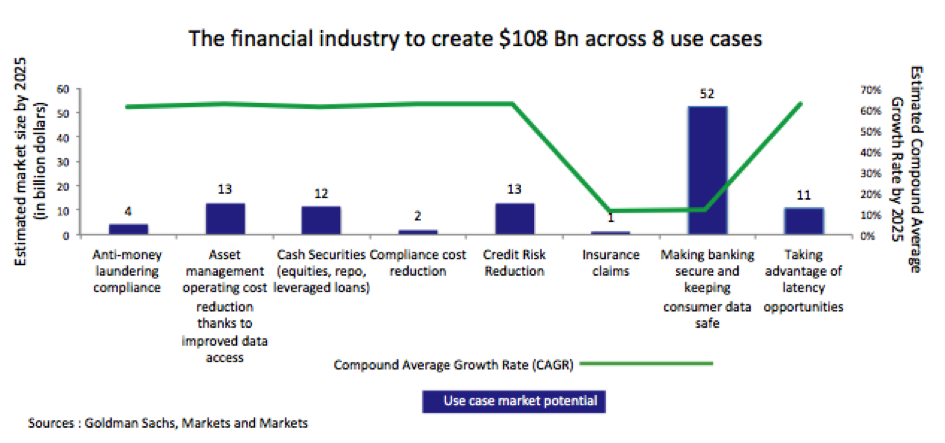

I/ The idea in short: 8 use cases should add up to a $108 billion dollar opportunity with an average compound annual growth rate over 50%.

Before we look at each innovation, here are a few elements to keep in mind: in 2014, a McKinzey Institute Survey shows that the global financial services add up to $13.1 trillion with an annual growth rate of 6% compared to a $108 billion value creation opportunity with a 50% CAGR for use cases. Considering that fintech investments have attracted over $31 billion in 2016 and 2017, the use cases below provide only a partial figure of potential.

II/ Overview of each innovation use case

- Anti-money laundering compliance and “Know Your Customer” (KYC) compliance stand as a $4 Bn market opportunity with a CAGR exceeding 50%. Account and payment information is stored on a Blockchain providing a tamper-proof record and reducing the number of falsely identified “suspicious” transactions.

- Asset management operating cost reduction harnesses space-sourced big data to capture information on the global economy, helping understanding changes in demand and production in real time.

- Despite the low transaction costs of securities such as equities, almost “10% of trades are subject to various errors, leading to manual intervention” and increasing operational costs, according to Goldman Sachs’ Blockchain report. Blockchain could free up $12 Bn in fees, OpEx and capital charges.

- Compliance cost reduction: with the 2007 financial meltdown, the Obama administration and the European Union implemented regulations to prevent an additional breakdown, creating to rising compliance policies. Citigroup is allocating 30% of its total headcount to compliance. AI enabled checks may speed up existing activities.

- Applying AI to identify credit risk and execute account closures should save up to 13 Bn dollars in the financial industry, as a whole.

- Drones inspecting disaster zones harnessing AI to analyze images should result in shortening the insurance claims process and improve client satisfaction.

- With a $52 Bn potential and a 15% CAGR, cybersecurity to minimize data leaks on mobiles stands as a promising use case.

- Finally, in 2015, more than 1.7 trillion U.S. equity shares were traded highlighting plenty of opportunities for trading firms to take “advantage of the miniscule latency windows where the latest price of a security exists on raw exchange feeds but not consolidated market systems”, according to Goldman Sachs’ Artificial Intelligence

III/ Questions to Senior Leaders

In any case, Senior Leaders may consider the following:

A/ Setting goals

- What share do they want to capture out of the $108 billion at stake: 1%? 10%? 50%? Nothing? How much? What are the implications for shareholders?

B/ Understanding competition

- What’s competition take on it?

- What are the Corporate Venture Capital Investment trends in their industry?

- How is competition using M&A to penetrate promising market segments?

C/ Assessing the status quo, internally

- In what way does current resource allocation reflect stated goals?

- In what ways are Senior Leaders steering their corporation in a direction conducive to growth, right now?

- In particular, what’s their existing innovation portfolio looking like? How many projects made it to the innovation pipeline? What’s the consolidated value creation objective?

- Which innovation project promise to generate highest value in the next few years? How does it compare to the $108 Bn at stake?

D/ Designing an innovation strategy

- What innovation capabilities are Senior Leaders considering developing to capture a share of the $108 billion at stake: partnering with VC, building a Corporate Venture Capital team, developing open innovation programs, financing R&D programs with universities, acquiring startups to incorporate latest tech, growing innovation talent from within, all of the above? How much should each of these programs claim out of the $108 Bn at stake?

- What measurable results are coming out these initiatives? Have they resulted in novel value propositions and value acquisition for the company?

- What’s their comparative capital efficiency? Does one program return 3x (3 times the invested capital) while another returns 0,8x (80% of the invested capital)? If so, how has this affected further innovation capital deployment?

In a forthcoming article, we’ll look at 2 use cases in more detail: compliance cost reductions and asset management operating cost reduction.

No comment