What technologies should innovation companies select to pursue growth ? Where should forward-thinking leaders put their capital, talent and energy ? Artificial Intelligence, Blockchain, Virtual Reality and Augmented Reality stand as some of the most trendy techs. But is their value beneath the hype ? If so, how much, in what industry and on which use case ?

Addressing these matters prove crucial to:

- Investors looking to select the more promising startups among an annual dealflow made up of 1000+ Business Plans

- Incumbent industrial companies aiming at developing relevant capabilities to secure future growth,

- Established digital players such as Fujitsu, General Electric, Atos, Cap Gemini, IBM and Accenture.

I/ Trendy tech awards

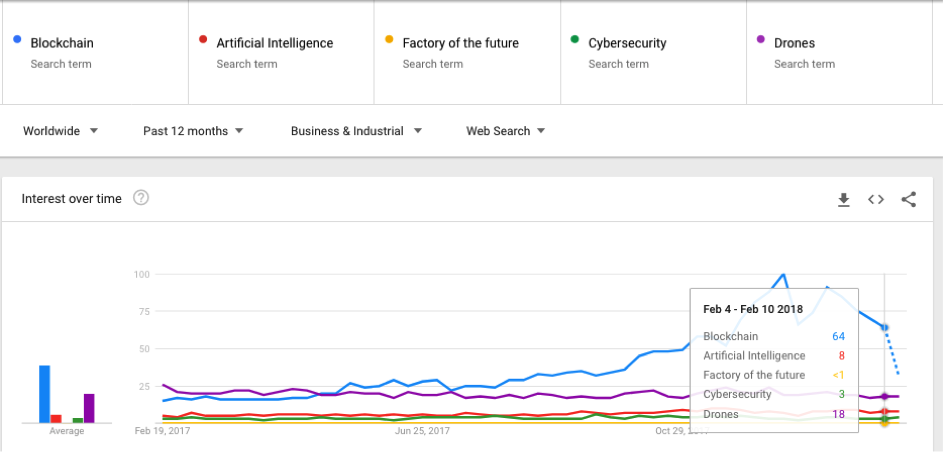

A quick look on Google Trends paints the following picture:

Blockchain sits as the most popular technology based on the number queries on google.com. But, looking at technologies in terms of value creation potential upsets the pecking order.

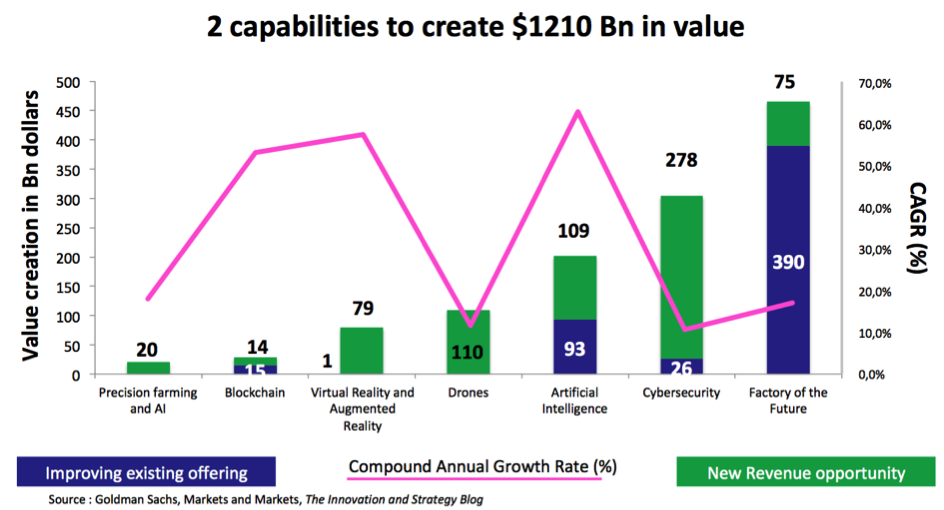

II/ Value distribution across all 7 technologies grants top seat to the “Factory of The Future”

According to Head of the European Capital Goods Equity Research Team at Goldman Sachs Daniela Costa, “Factory of The Future” technologies, combining Cloud and IoT to connect “dumb” Second-Revolution-manufacturing-assets to Third Revolution Infrastructure, stand as the most value-creating space, though less trendy than Blockchain. Cybersecurity appears to be a hot spot for new revenue generation.

Precision farming and AI require developing new activities

Agriculture incorporated digital technologies after many other industries. Established companies in the agricultural segment may develop additional capacity in digital technology and claim a share in this $20 billion in value. But there could also be startups wanting to bring digital technology to the agricultural industry which could tap into this value as well. Applications cover precision irrigation, moisture sensing, precision spraying, precision fertilizer and compaction reduction, among others.

Blockchain technologies to improve existing offerings while opening up new markets

New revenue generation opportunities and improving existing offerings are evenly distributed in the blockchain technology segment.

- The former includes applications in the sharing economy and lodging. Blockchain certifies the owner and guest’s identity.

- The latter involves anti-money laundering compliance.

VR and AR to create new market segments

VR and AR are mostly new revenue opportunities although many established players in the hardware and video industry may deploy capabilities in-house in order to address this market. Disruptive startups have room to grow. Acquired by Facebook for $2 billion, Oculus, a manufacturer of VR hardware, became a leading company in the VR space, long before Sony, often viewed as a time-tested corporation in consumer electronics.

Innovation VP at Bouygues Group, Christophe Liénard, once told me that the Paris-based industrial company is turning to Virtual Reality to create “digital twins” in order to simulate construction work virtually before starting the “real” engineering job, minimizing redundancies and optimizing project management.

Drones technologies should lead to novel business lines

Drones are also expected to generate new revenue opportunities, providing growth opportunities for startups. In France, Parrot is addressing the drone market and is becoming a global leader in the consumer electronics space.

Artificial intelligence to improve existing products while generating new offerings

In finance, regulations have increased in number since the 2008 financial meltdown. Today, private banks must go through over 1000 pages of legal documents in order to onboard clients. According to J.P. Morgan’s most recent annual report, the company increased compliance spend by 50% to $9 Bn between 2011 and 2015. To the same tune, Citigroup indicated in 2014 that their compliance employee headcount grew to 30,000, representing over 12% of their employee base, according to Goldman Sach’s report on Artificial Intelligence. Automatizing a share of these recent regulation-enforced activities opens the door to a 2 billion dollar cost saving possibility.

The technology can also be used to generate new revenue streams. In the oil industry, companies like Schlumberger and General Electric are gathering data all along the extraction process, in order to spot improvement opportunities. Minimizing delays and reducing downtime pave the way to creating a 14 billion dollar market, according to Goldman Sachs.

Cybersecurity consists in creating new markets

Cybersecurity is mostly a new revenue generation opportunity segment. In the cybersecurity space, most applications involve improving existing offerings by adding a supplemental layer of security. Protecting cloud-based enterprise storage systems and preventing data leaks establish a new market, valued at $26.3 billion.

Factory of the future technologies to improve existing assets

Finally, improving existing offerings proves crucial to creating value in the factory of the future segment: cloud-based enterprise resource planning solutions, industrial robotics, addictive manufacturing, among others account for a $390 billion dollar opportunity.

In a nutshell

Incumbent corporations will fight over 526 billion dollars by improving their existing offerings while an additional 685 billion dollars in new revenue generation is up for grabs, within the reach of current digital companies as well as entrants. The key here is for established players to develop innovation capabilities to capture the highest share of value. Building a credible innovation engine—not just communicating on innovation—proves crucial to growth in the near future.

In the next article, we’ll revert to an industry focus and take a deep dive in financial industry use cases.

No comment