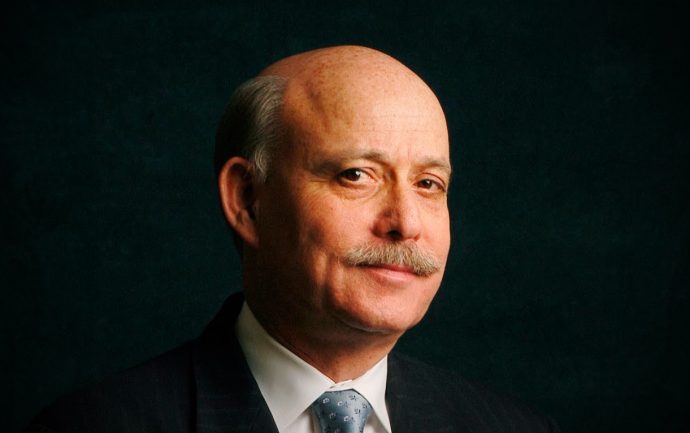

How could investors reduce risks and ensure profitability? How could they get a clear understanding of future revenue? In what way could real estate investors benefit from a revenue generation simulation solution? Founder of Airbtics, Jae Seok An and myself addressed some of these questions in a recent conversation. Introducing Jae Seok An, Founder of Airbtics, a revenue generation simulation solution Brought up in South Korea,…