Building unicorns: sure! But why?

How is the current French president, Emmanuel Macron, planning on creating an innovation ecosystem conducive to giving birth to 25 unicorns by 2025? What is it about the existing French economy that must be overhauled? And why is it important for France to be producing unicorns in the first place? How does this tie into value creation and jobs? Plus, are there any signs showing whether the country is on track to meeting the stated objective? These are some of the questions that sprung to my mind when I joined the France Digital Day event in mid-September, following the invitation of its co-President Jean-David Chamboredon, the co-founder of ISAI Capital and author of Génération Pigeons (Michalon, 2012).

A prosperous economy in unstable environment

The French economy is relatively prosperous, despite slow growth since the outbreak of the 2008 financial crisis. But the country has been grappling with unemployment problems for at least 30 years: 8% unemployment is considered to be very positive figure while the United States enjoys near full employment and negative unemployment (more jobs than people) for most positions in the digital industry. It turns out that 1/3 or even, in some US states, half of job creations come out of the tech industry. A prosperous technology landscape is conducive to generating a great number of jobs despite widespread fears that artificial intelligence will displace millions of white-collar positions.

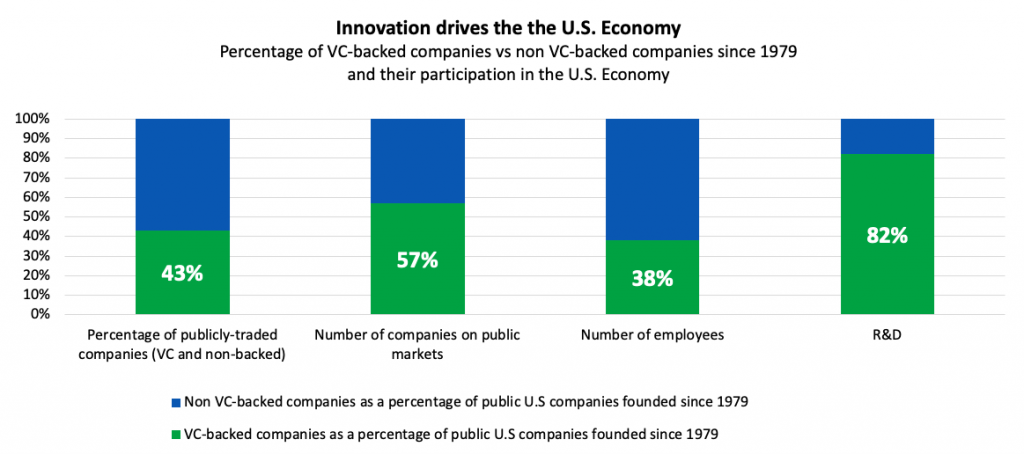

According to Standford professor, IlyaA.Strebulaev and Assistant Professor of Finance at Sauder School of Business UBC, Will Gornall, VC-backed companies are bolstering the US Economy in terms of jobs, R&D and shareholder value creation:

Today, the French economy is growing faster than most euro-zone countries while unemployment is decreasing. In many ways, France stands as a safe haven in otherwise a harsh European and global environment. As William Horobin from Bloomberg puts it : “France is Europe’s new economic growth engine.”

The aging companies making up the French Stock Index suggests a changeless economy

Another take on the French economy comes from looking at the French Stock Index where the top 40 corporations are, on average, 105 years old. The NASDAQ, on the hand, includes companies whose average doesn’t 15 . The GAFAs (Google, Amazon, Facebook and Apple) are 20 years old.

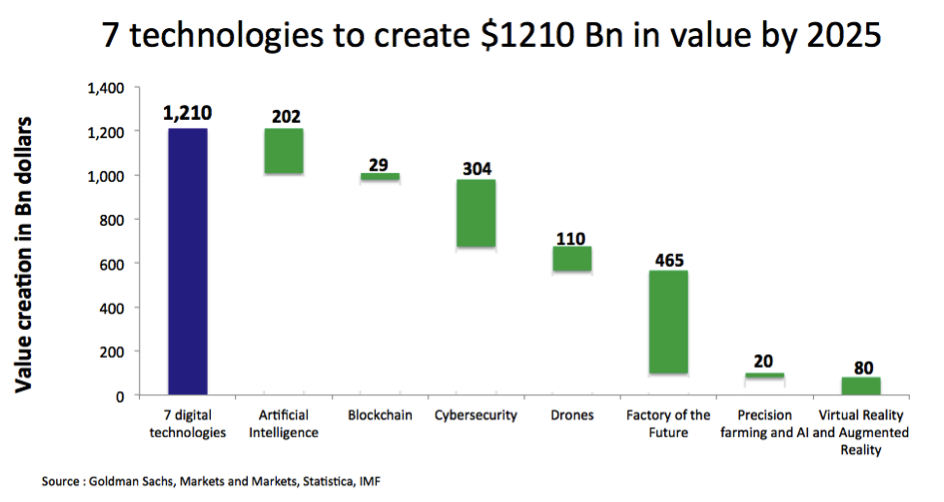

This shows a lack of ability to produce global giants that are leveraging contemporary technologies such as artificial intelligence, blockchain, Internet of things, virtual and augmented reality, drones, Internet of Things and cybersecurity. Yet, according to Business Unit Leader of the Technology Research Group at Goldman Sachs, Heather Bellini, 7 technologies should create 1210 billion dollars by 2025 :

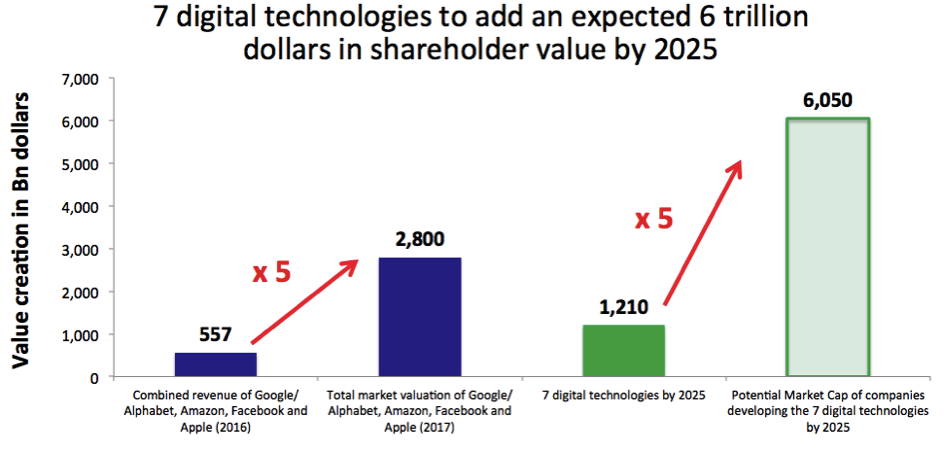

… and over 6000 billion dollars in shareholder value :

In the digital economy, Europe needs to speed up to maintain its competitiveness

Plus, Joe Schoendorf, an investor from Accel Ventures, stress that if one were to look at the top 10 websites in the world or the top 10 technology companies by revenue or by capitalization, one would find no European nor French companies. They are all American or Chinese.

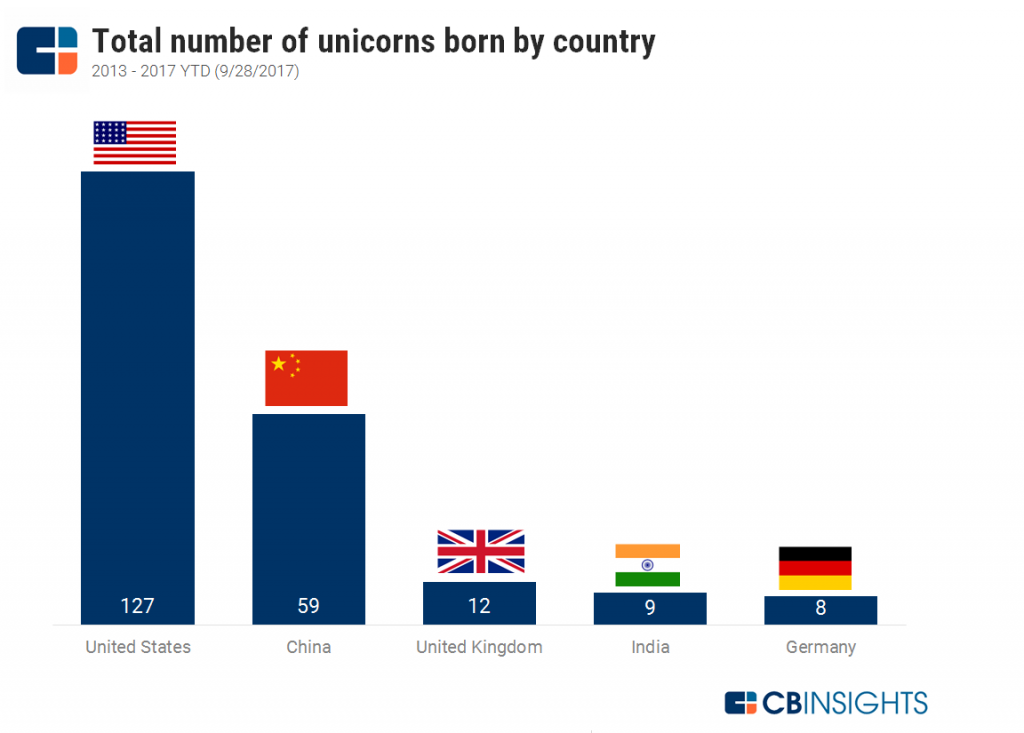

The secretary of state to digital affairs, Cédric O, mentioned that this is also true for unicorns as a whole: the United States and China are home to the largest number of unicorns with Europe lagging far behind.

Innovation proves crucial at building a sovereign country

According to the French President, Emmanuel Macron, this raises a number of issues, including one pertaining to sovereignty. The concept, often cherished by nationalists, simply means making one’s own economic and technological decisions, according to one’s value and principles. A country failing to produce enough unicorns may not enjoy this freedom of choice. To this effect, in addition to pursuing innovation-friendly policies, the French President has shaped, to some extent, the agenda of the newly appointed European commission and pushed for building a unified European digital market.

Disruptive-players-turned-to-monopolies are suppressing innovation

Also, according to the French President, Emmanuel Macron, a number of novel companies with established positions are turning into monopolies. They conduct mergers and acquisitions, not so much to improve their product offering, but rather to defend themselves. So, unexpectedly, many digital startups are actually stifling the innovation fabric that help them launch in the first place. Margrethe Vestager’s mission will be to spot “innovation-killing” M&A’s while enforcing free markets in a much faster way. Deep-pocketed Californian companies must compete on an equal basis with European-born startups even if the latter hold less capital.

The French innovation ecosystem is on the right track

Growing investments in innovation

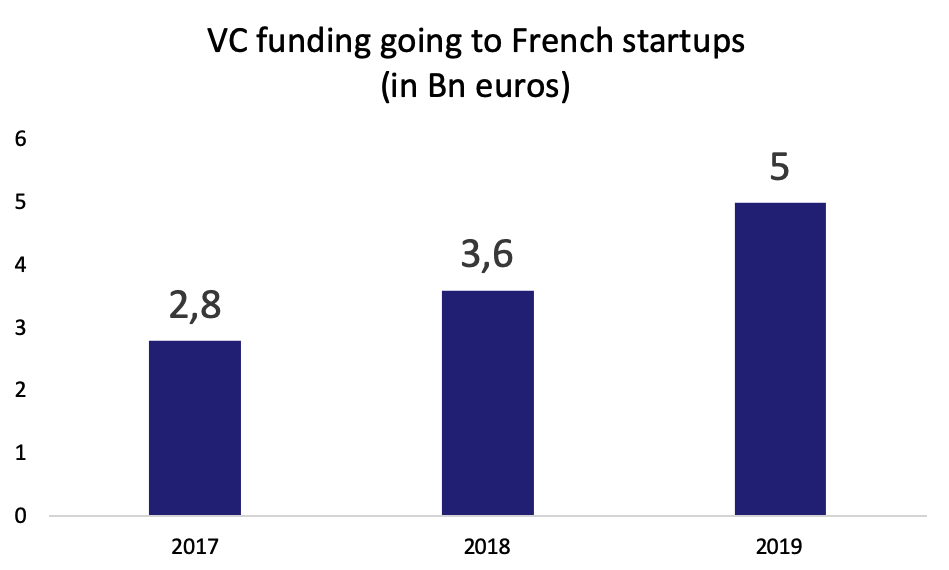

As mentioned in my latest book, 1200 billion dollars up for grabs: how to capture it and turn France into the Silicon Valley of 2030? The French President indicated that France is on the right track with rising. Consolidated investments in the French ecosystem are growing as shown below:

Lack of late stage capital

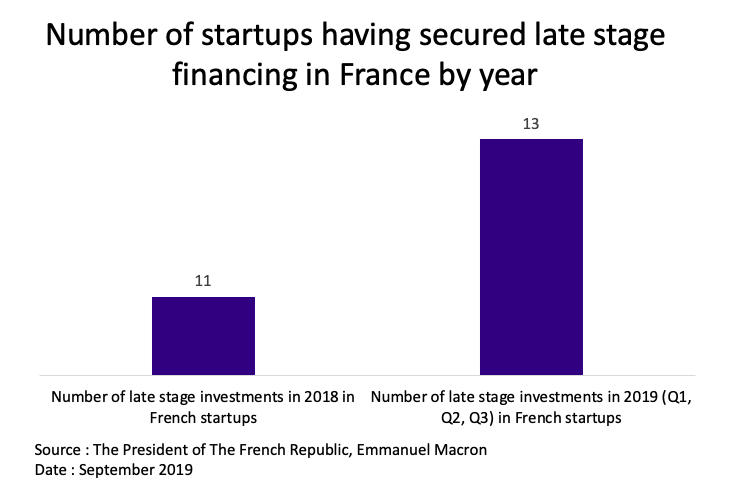

But, for a number of years late stage capital is lacking. Former advisor to the French government, and former CEO of the French railway company SNCF, Louis Gallois, has coined the term “Death Valley” as a moment where a startup is running out of cash and can’t find late stage money. And yet, the current ecosystem is continuing to improve with 11 startups that secured more than €50 million in financing in 2018 and 13 in the 9 months of 2019.

5 billion Euros to boost late stage investment capacity

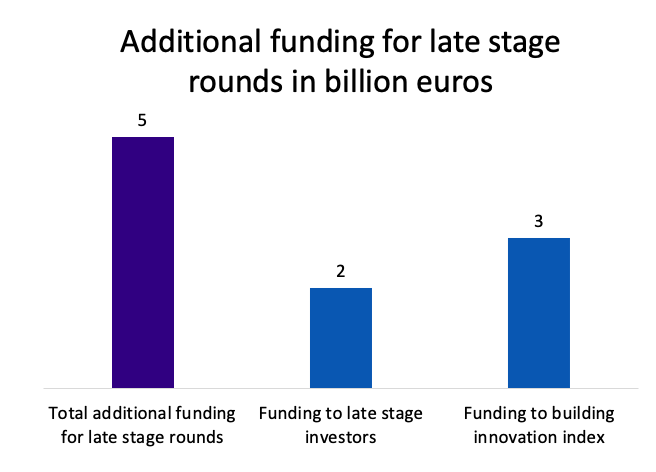

President Macron wants to provide even more capital to late-stage investors. Therefore, following a report entitled “Funding the Fourth Industrial Revolution” written by the former Country Manager of UBS in France, Philippe Tibi, the President is allocating €5 billion to boost the late-stage funding scene.

- 2 billion are going to late-stage investors to help France’s top 40 most promising startups – known as the “Next 40” – to seek much-needed capital.

- 3 billion are going to lay the foundation to a “technology-only Index” made up of the “Next 40”. Insurers and bankers may include this novel index in their wealth management plans thereby laying the foundations for a European NASDAQ.

A quick work on the “Next 40” : They are high potential startups with an aim to becoming world leaders generating at least 5 million Euros in 2018 and boast an Compound Annual Growth Rate (CAGR) of 30% in the last three years. Notable “Next 40” startups include : BackMarket, BlaBlaCar, Blade (Shadow), Deezer, Devialet, Doctolib, Ledger, Meero, Mirakl, OVH, Sigfox among others. Another group of 80 less mature and just-as-promising startups will be added to the Next 40 and will grow the list to the top 120 startups, known as The French Tech 120.

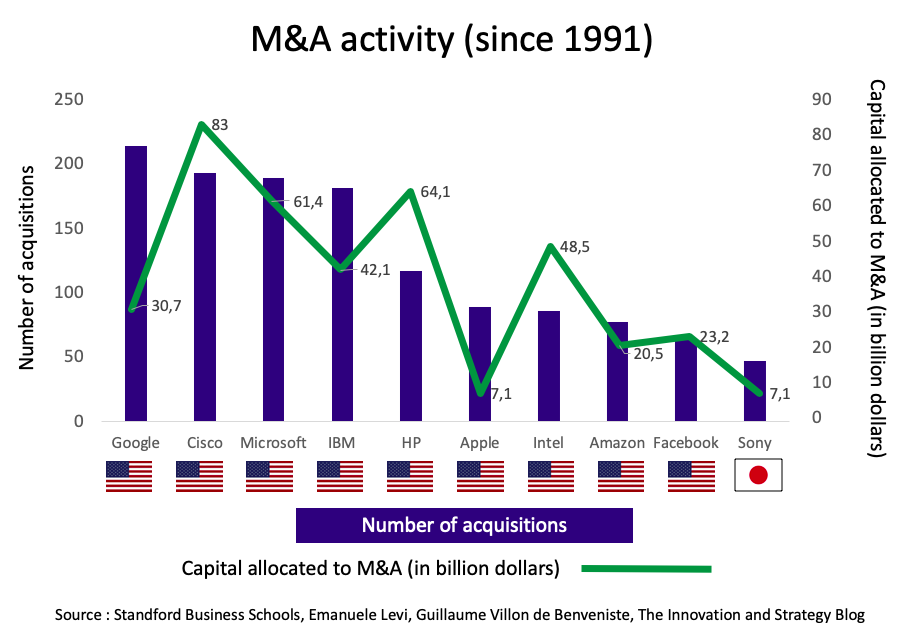

Philippe Tibi’s report also mentioned the lower number of startup acquisitions in Europe, thereby depriving VC and founders of a notable exit. Vibrant Tech M&A in the US stands in stark contrast to European Tech M&A. Most industrial acquirers are based in the US, as shown in the graph below :

I don’t believe that this topic was mentioned in the Presidential announcement so I guess that it will be addressed in the near future.

On another note : I was quite surprised that the chosen language for the event was English. I guess this shows a willingness to attract foreign investors. President Macron has held numerous meetings with experienced from Silicon Valley that played a pivotal role in turning the Valley into the world’s innovation hub. They are assisting him in building a promising entrepreneurial ecosystem in a country that performed superbly during the agricultural revolution and in the second Industrial Revolution also known as the “Belle Epoque” era.

Only a few people know that the inventor of the venture capital industry was actually French. He went by the name of George Doriot and was born in 1899 in Paris right by the senatorial garden, The Jardin du Luxembourg. He joined the US Army, became General and founded INSEAD upon his return to France after World War II.

Although blooming, the French Innovation ecosystem has room for improvement

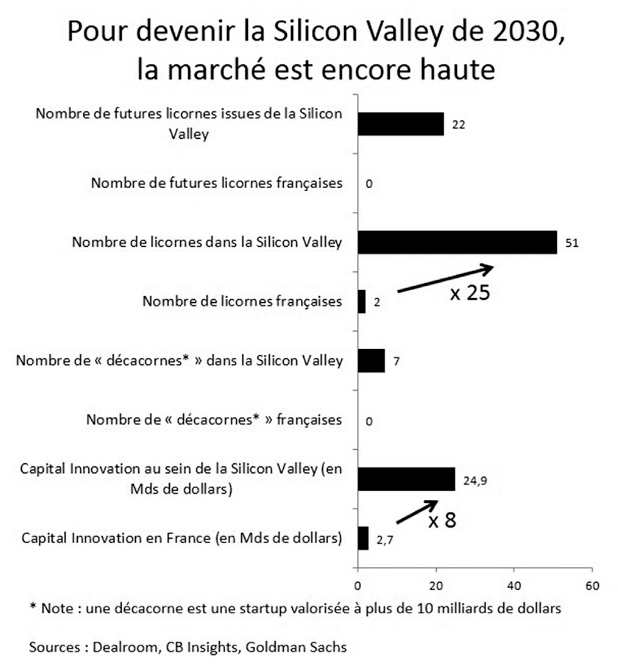

According to Matthieu Lattes, General Partner at White Star Capital, building unicorns is only part of the story. In interview with La Tribune, Matthieu believes that laying the foundations of a global ecosystem developing startups valued a $10 billion pre-IPO, also known as “decacorns“. As mentioned in my latest book, there is, indeed, quite a way to go for France to match Silicon Valley. In the graph below, I look at the quantitative differences between France and the Valley. Figures date back from 2017:

France Digital Day is a seminal event

Well thought out, the event hosted keynotes from prominent decision makers. The event itself would be probably be even better if there was more room interactive workshops enhancing networking between venture capitalists, entrepreneurs, corporate development, decision makers, and other innovation-hungry experts. In any case, these are the main takeaways I got out of France Digital Day.

I should add that many were disappointed that there’s only 5 billion euros going to late stage investment. In his report, Philippe Tibi had asked for 20 billion euros to support developing startups. According France Digital’s founder and co-president, Jean-David Chamboredon, “long-term institutional capital, allowing significant sums to be mobilized over time, continues to be insufficient (despite very abundant savings). Our ecosystem is dependent on international investors […]. The President of the Republic has made announcements[…] that are heading in the right direction, but we must not delay their implementation….”

In a follow-up article, I’ll show how 5 billion euros can turn into 15 billion without spending an extra dime…

[…] de croître. Mais, transformer les startups en géants mondiaux reste déterminant pour assurer la souveraineté technologique de la France, créer des emplois et financer la Recherche et Développement sur les technologies futuristes, […]

[…] de croissance disposant de 2,5 milliards, c’est très conséquent ! N’oublions pas que les récentes annonces du Président Macron visent à obtenir 5 milliards d’euros de fonds de …. On a donc, aux Etats-Unis, plusieurs fonds de croissance qui ont davantage de moyens financiers […]