What are the strategies for investing in innovation? How to provide access to opportunity while managing risks carefully?

I used to think that the Net Present Value (NPV) metric was the best to enable value generation while minimizing risks. But, innovation investment expert, Claus Hirzmann thinks otherwise. He told me why in a recent conversation at Vivatech. It’s all here !

- Please introduce yourself

My name is Claus HIRZMANN, and I am passionate about “competitive strategies for investing in innovation and enterprise agility – Real Options”. I have studied Electrical Engineering at the RWTH Aachen (Dipl.-Ing.) and hold an MBA from the IAE Aix-en-Provence.

During 24 years of professional experience in innovative industries, like Hewlett-Packard, Mondi Business Paper and Amadeus, I have held roles in R&D, Project Management, New Business Development, Corporate Strategy and Finance.

For 10 years, I share my passion by teaching Real Options based investment strategies at various business schools like IAE Aix-en-Provence, EDHEC Nice, EM Lyon, Skema Sophia-Antipolis. For 2 years, I work as consultant and bring this valuable solution to companies, in cooperation with my professor of finance , Prof. Olivier Tabatoni.

- What are your client’s pain points?

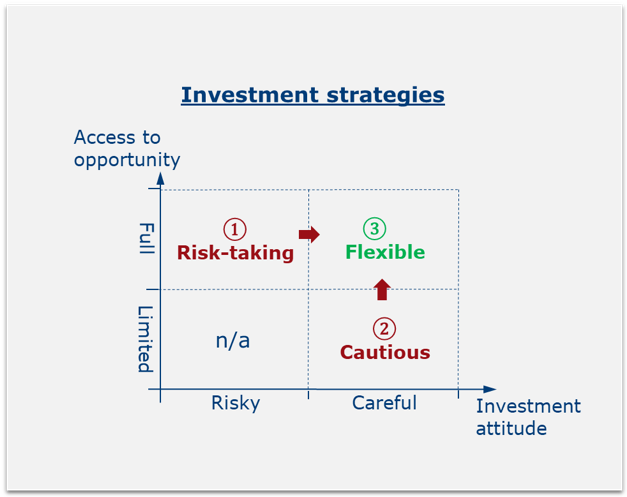

The NPV calculation as classic criteria is unsuitable for taking investment decisions in innovation projects or other uncertain projects like R&D/exploration, business development, M&A. When using the NPV criterion for such projects, companies struggle with reaching an investment decision and end up with either of these strategies: (1) Take the risk and invest or (2) be cautious and refrain from investing, invest only in rather sure opportunities.

Unfortunately, neither strategy is satisfactory: Risk-taking ensures access to an opportunity but puts capital at risk. Being cautious provides for a careful investment attitude but leads to missing most opportunities.

Ideal would be an investment strategy that combines the best of both: provide access to an opportunity while carefully managing investment risks. An according strategy exists and has been suggested by the MIT: (3) The flexible investments strategy. Adopters of this strategy can expect an outstanding access to innovation.

- Why are they feeling this pain?

Speed and uncertainty are increasing in most industries. To cope with these uncertainties, companies strive for operational agility to protect the present business, and for innovation to ensure their future. Thus, taking investment decisions in agility and innovation is an increasingly frequent duty and struggle.

- In what way is NPV modelling lacking when applied to innovation projects?

Innovation projects comprise three key elements: an attractive business opportunity, uncertainty to reach it, and a plan on how to manage the project with agility depending on intermediate results.

To take an investment decision, the innovation project needs to be accurately represented from a financial perspective. Unfortunately, the classic NPV modelling does not represent the innovative project properly, i.e. it ignores the three key elements of the innovation project.

Rather, the NPV represents one unique, linear project path, where all investments are pre-committed, and where all future returns are meant to be forecasted with reasonable confidence. Neither of these concepts apply to innovative projects. Hence, the financial representation by NPV modelling is disconnected from the realities of the innovation project. Unsurprisingly, the NPV fails to drive an investment decision.

- How are you helping your clients?

Ideas for innovation turn into reality only if you know how to invest in their implementation. This requires that the financial representation of the innovative project is accurate; only when the innovation project and its financial representation are well connected, one can expect to draw meaningful investment decisions.

Business Cases based on Real Options finance allow for the accurate financial representation of innovation projects: the attractive business opportunity is described, together with the uncertainty of reaching it and a plan on how to steer the project depending on intermediate results. This plan is designed to enhance positive evolutions and to mitigate negative ones. Accordingly, the risk profile of the project is significantly improved.

We help clients by bringing them Real Options finance as the suitable framework for investment decision making in innovation projects.

- What’s your value proposition?

Adopters of Real Options finance can expect to gain outstanding access to innovation:

- Know to invest the appropriate amounts at managed risks => Optimisation of investments

- Invest in projects that competitors would reject due to a highly uncertain or initially negative NPV, or due to neglection of the value of follow-up opportunities. => Creation of competitive advantages

- By taking less risks, be able to decide quicker & earlier than competitors => Create speed & first mover advantages

- In what way is your value proposition disruptive?

Users of the classic NPV approach hesitate to invest in innovation as the NPV criterion does not deliver a clear-cut answer: for reasonably optimistic scenarios, the NPV is positive, whereas for reasonably pessimistic ones, it is negative.

In this (frequent) situation, decision makers can resort to either strategy: (1) Take the risk and invest, or (2) Be cautious and do not invest unless the opportunity is virtually sure. Neither strategy is satisfactory.

A satisfactory investment strategy provides for full access to an opportunity while simultaneously managing investment risks carefully. Such an ideal strategy (3) exists. It has been proposed by the MIT and is based on a stepwise investment paradigm instead of the all-or-nothing investment concept of the NPV approach.

In the stepwise approach, each project step provides for the Real Option on the next step and ultimately on the possible great success. The investment decision is just about buying the next Real Option or not. All subsequent investment decisions are open and depend on the learning achieved from completed project steps.

In other words, the investment decision is no longer based on a blunt “is it worth to do all investments ?” consideration but on the appropriate question of “is it worth to invest in the next project step such as to buy an option on the project’s success ?”.

- What are the client benefits?

Beside the benefits listed in the value proposition, clients gain a rational and efficient framework for turning ideas to reality. This transforms the company, and everyone in a company is enabled to be a source of innovative ideas.

- Could you talk about specific use cases and/or examples?

Real Options finance is suitable for innovation projects, R&D/exploration, business development, M&A, as well as creation of agility in production, purchasing and sales.

Our customers use Real Options finance to decide about the creation of technology platforms, innovation projects, innovative project portfolio management, structuring and negotiation of M&A deals (earn-out clauses), market penetration strategies, design of flexible purchasing and sales contracts, creation/negotiation of agile production facilities.

- How are you helping your clients with innovation investment?

To bring Real Options finance to our clients, we typically begin with a small, concrete sample project from the company. This allows decision makers to appreciate how the methodology works and what benefits it yields.

Then, we teach Real Options finance to a set of company internal “ambassadors” from various departments, including corporate finance, corporate strategy, innovation, R&D, operations and M&A. In addition, we provide some brief learning material about the mindset and benefits of Real Options finance, such that everyone in a company can feel enabled to voice his or her ideas to the ambassadors. They will then evaluate the idea with the help of Real Options representations.

As the translation of business ideas into Real Options representations requires some practice, we provide support to our clients through consulting services.

- How have you helped increase innovation capital efficiency?

The stepwise investment approach in Real Options allows for innovation capital efficiency through these levers:

- Investment flexibility: the investment continues as long as justified but stops as soon as necessary.

- Investment profile matches risk profile: the initial investment is the riskiest one and therefore designed to be the smallest. The next investment takes place only if the previous step was successful. Thus, it is less risky, and the investment can be more substantial. Finally, the last investment will take place only if all preceding steps have resolved positively; the last investment is the least risky one and thus can be the most substantial one.

- Adjustment flexibility: if the result of a step is not a success, then the defined measures are taken to mitigate losses. For example, one may sell off the used assets and recuperate their residual value. Or, if some innovative technology fails on the initially targeted market segment, it may be repositioned to another market.

Moreover, when extending this approach to the management of an entire project portfolio, it becomes possible to revaluate and to financially optimize the portfolio regularly.

- How would you describe your ideal client?

The range of ideal client is broad, as virtually everybody is keen on getting outstanding access to innovation or similarly uncertain business projects. This includes people in charge of innovation, R&D/exploration, business development, M&A, production, purchasing, sales, corporate strategy, corporate finance, corporate VCs.

What all these people have in common are ideas and the need to turn these ideas to reality by knowing how to invest in their implementation. Otherwise, their ideas just remain ideas.

No comment