Fabrice Grinda, the world’s top seed investor, is developing an efficient investment strategy and achieving a steady 68% realized Internal Rate of Returns since 2009 across 540 startup investments by following a specific investment guide.

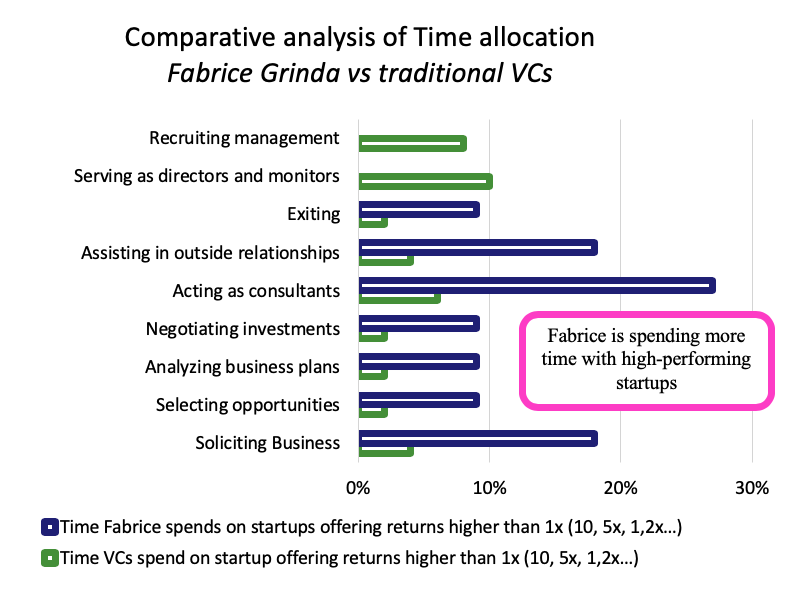

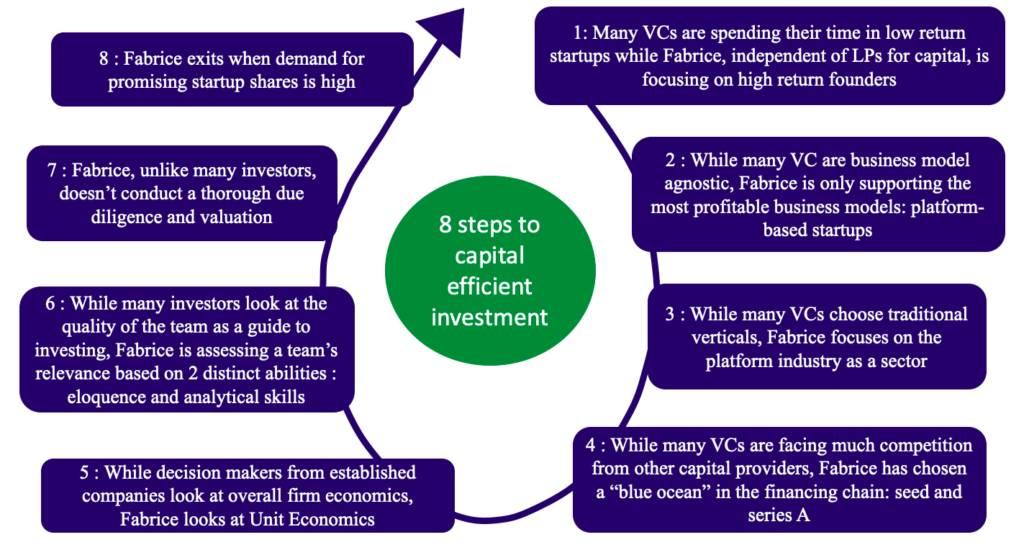

Fabrice is following an investment philosophy much different from most Venture Capitalists:

- 1/ Many VCs are spending their time in low return startups while Fabrice, independent of LPs for capital, is focusing on high return founders

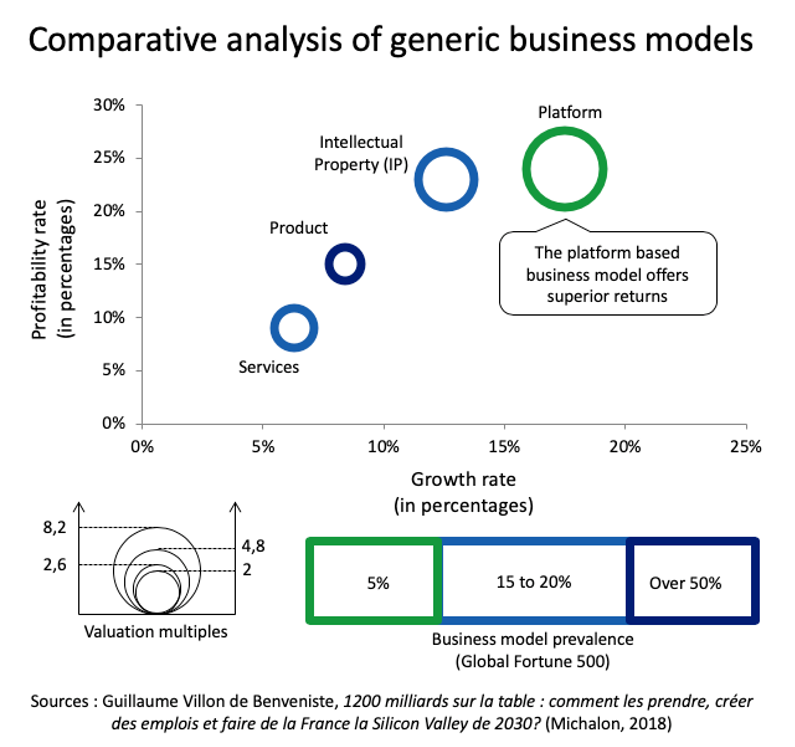

- 2/ While many VC are business model agnostic, Fabrice is only supporting the most profitable business models: platform-based startups

- 3/ While many VCs choose traditional verticals, Fabrice focuses on the platform industry as a sector

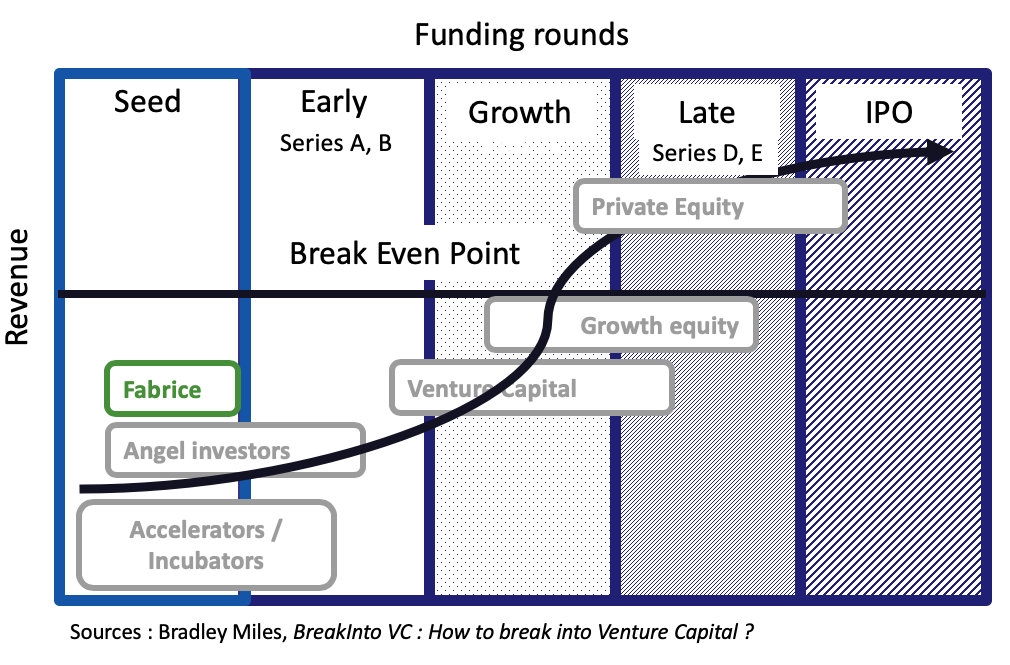

- 4/ While many VCs are facing much competition from other capital providers, Fabrice has chosen a “blue ocean” in the financing chain: seed and series A

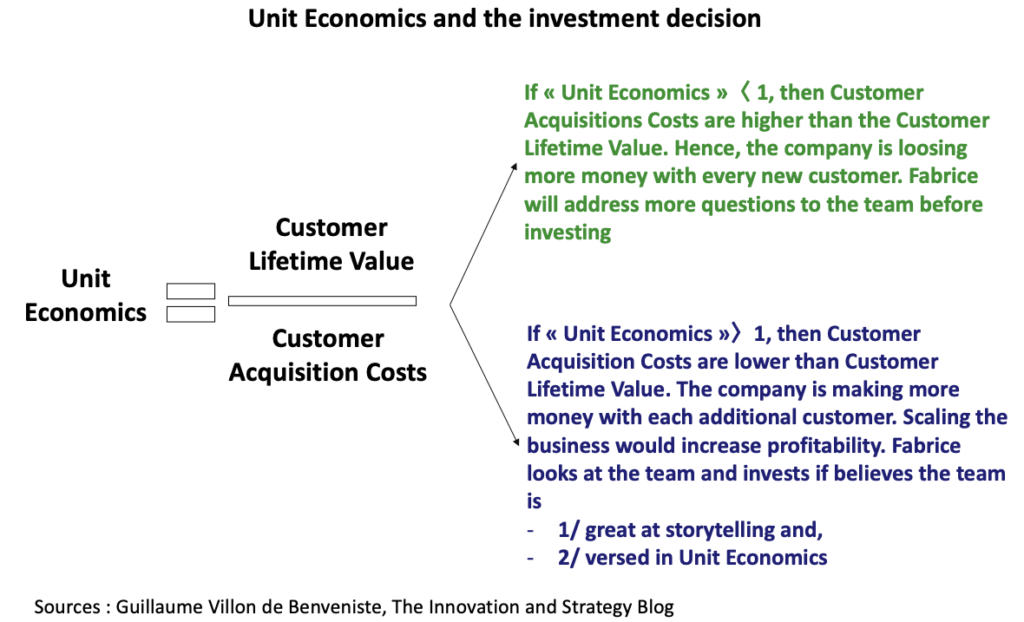

- 5/ While decision makers from established companies look at overall firm economics, Fabrice looks at Unit Economics

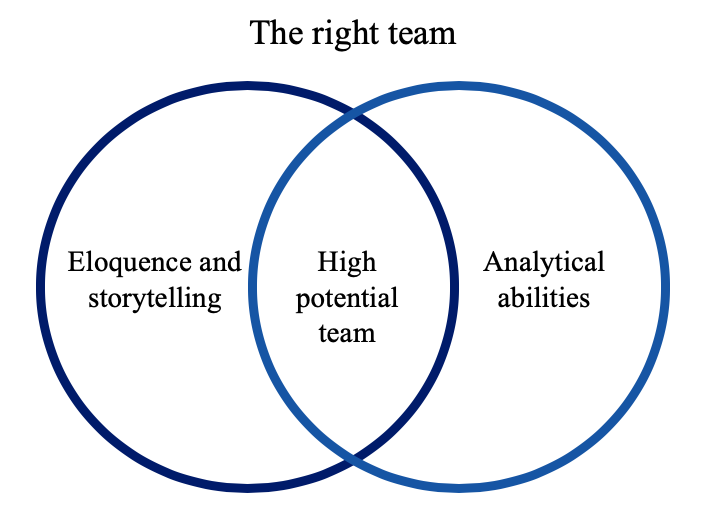

- 6/ While many investors look at the quality of the team as a guide to investing, Fabrice is assessing a team’s relevance based on 2 distinct abilities : eloquence and analytical skills

- 7/ Fabrice, unlike many investors, doesn’t conduct a thorough due diligence and valuation

- 8/ Finally, Fabrice exits when demand for promising startup shares is high

Fabrice Grinda & Guillaume Villon de Benveniste

So that’s how Fabrice Grinda’s investment strategy helps him generate superior returns in Venture Capital.

No comment