In a previous post, I discussed how the world’s top seed-investor, the Franco-American Fabrice Grinda is generating superior returns in seed investment. I discussed 2 of his 8 principles, including wise time allocation and going for startups operating on platform-based business model. Today, I talk about several other principles related to platforms and funding positioning.

Third principle on generating superior returns in seed investment : fund platform startups disrupting established platform players

While many VCs choose traditional verticals, Fabrice focuses on the platform industry as a sector :

Why focus on disrupting platforms when countless market segments remain unaddressed by platform-operated businesses? The sort answer is risk mitigation. As shown below, many startups fail because they aren’t tackling a tangible need. As Fabrice is supporting platforms aiming at disrupting other ones, he knows that he won’t be back “a solution looking for a problem”. Plus, assessing whether the customer’s experience improves as clients go from the established platform to the would-be disruptor appears much easier. If, for example, the novel offering lowers customer costs, provides a faster and more expedient service and an enhanced matching algorithm, then, it’s standing a good chance of displacing incumbents. Conversely, a fresh platform failing to produce any of the above shows limited potential.

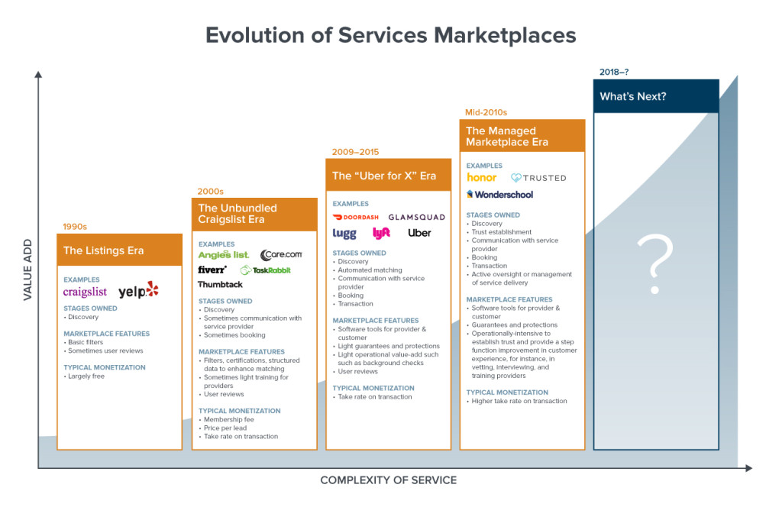

As Li Jin and Andrew Chen point out in “What’s Next for Marketplace Startups?” on Andreessen and Horowitz’s blog, the “marketplace industry” has gone through multiple phases in the last 15 to 20 years:

The listings era (1990s) consists in digital version of the Yellow Pages, detailing service providers and sharing their contact information. The user would reach out to suppliers and consider whether to work with them based on their personal judgment.

In the unbundled Craigslist Era (2000s), startups would disrupt one specific sub-vertical by offering superior customer experience. According to Ji Lin and Andrew Chen, Care.com carves off the Childcare section of Craigslist, and provides tech value add in the form of filters, structured information, and other features to improve the customer experience of finding a local caregiver. It’s a huge leap in terms of user experience over Craigslist’s Childcare section.

In the Uber for X era (2009-2015), widespread mobile adoption enabled on-demand marketplaces for simple services arose, including transportation, food delivery, and valet parking with the tap of a button.

In the managed marketplace era (mid-2010s), companies are involved in offering the service, and in doing so, enhance the customer experience. Rather than just helping customers to interact with the end provider, these marketplaces are involved in building trust. Opendoor is improving the experience of buying and selling a home. When a client wants to sell his home, Opendoor purchases it, maintains it and finds the next acquirer. Contrast this with the usual way of selling a home, with the hassle of repairs, listing, showings, and potentially months of uncertainty.

Now how does tie into creating capital efficiency and improved rates of return? All in all, I’m estimating, based on CB Insights’ recent risk analysis that focusing on disrupting established platforms means reducing risk factors by 46%, thereby doubling capital efficiency.

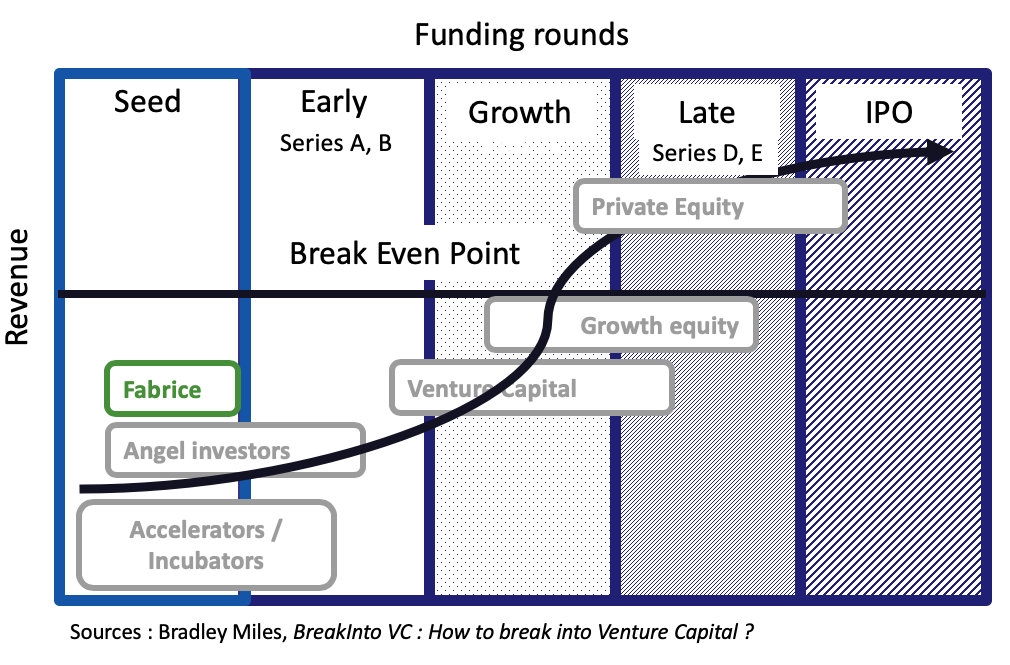

Fourth principle on generating superior returns in seed investment : flee funding competition and offer investment where demand for capital is high

While many VCs are facing much competition from other capital providers, Fabrice has chosen a “blue ocean” in financing chain: seed and series A

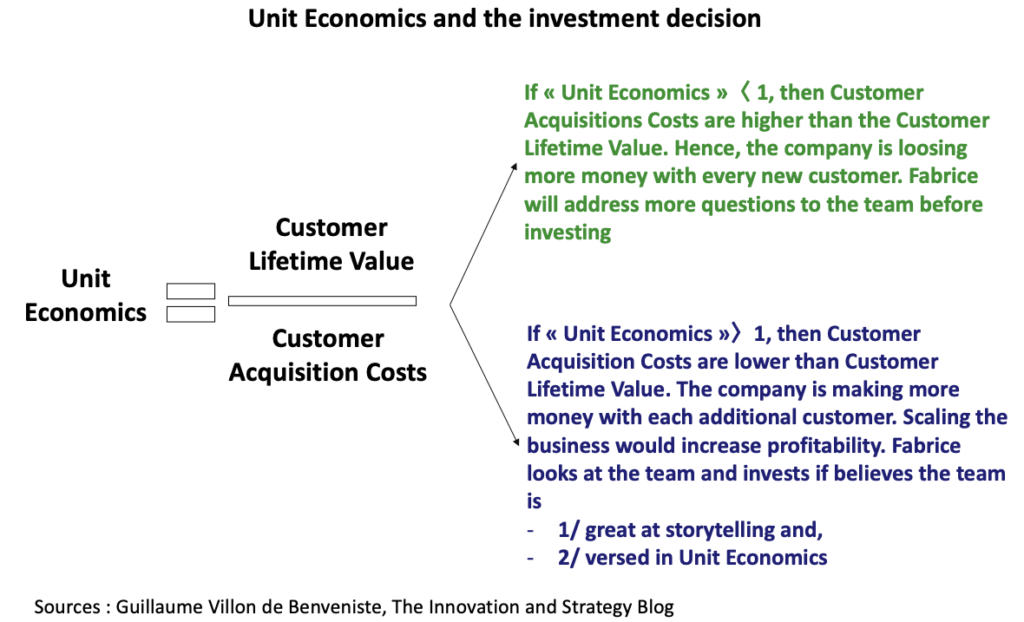

Fifth principle : While decision makers from established companies look at overall firm economics, Fabrice looks at Unit Economics

Most startups lose money. Yet looking at the following metrics proves crucial:

- Recovering customer acquisition cost in six months on a unit by unit basis.

- Understanding whether the startup is getting a 3X contribution and net margin on its customers as a whole in 18 months also proves crucial.

- Getting to a negative churn is important too. Even if startups lose 50% of their clients, having the remaining 50% order more and more proves critical. It could be that the lifetime customer value is 10 X, 20 X or 30 X higher than the customer acquisition cost. If this is the case, then the startup is on to a promising venture.

Generally speaking:

- If the unit economics are attractive, then, Fabrice will look at the team and consider investing.

- If the unit economics aren’t there yet, then, Fabrice looks for data suggesting that, in time, Founders will see attractive returns. This may include analyzing the average spend in the industry and assessing whether the startup could reach profitability at a lower price point. If, the unit economics are still absent, then, Fabrice would be looking for proof that scaling the business could help reduce costs and improve the margin.

[…] unit economics […]

[…] While many VCs choose traditional verticals, Fabrice focuses on the platform industry as a […]