In a previous post, I discussed how Venture Capital creates value. The Venture Capital business consists in investing in money-losing companies offering superior growth rates and the prospect of 100x returns in 5 to 7 years. But, in truth, many VCs don’t return the capital to their Limited Partners, as Private Equity and advisor to the Kauffman Institute, Diane Mulcahy has shown in an HBR article titled : Venture Capitalists Get Payed Well to Loose Money.

However, Fabrice Grinda, a Franco-American entrepreneur turned super-angel, is achieving a 68% realized Internal Rate of Return. What’s his secret? What are his investment principles? Fabrice and I covered these questions in a recent conversation. In this article, I talk about the first two of his 8 investment principles, after providing a short bio.

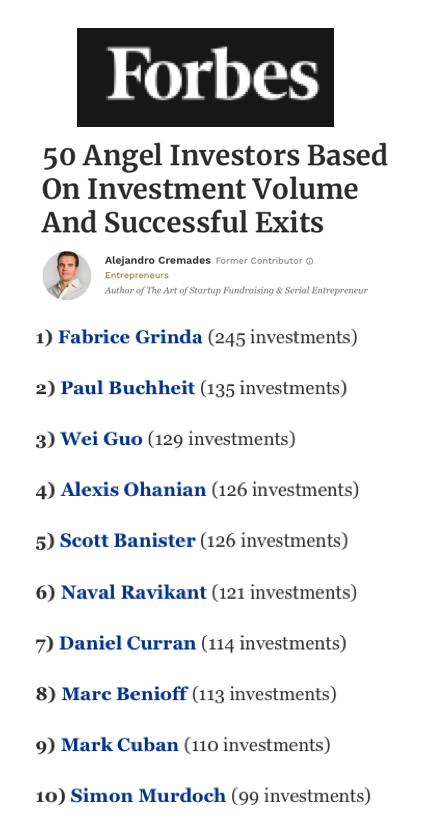

Introducing Fabrice Grinda, the world’s top seed investor

A Franco-American entrepreneur, super angel and blogger for Business Insider, Fabrice has invested in over 540 startups including AliBaba, AirBnB, Palantir Technologies, Beepi and Windeln generating 300 million dollars in exits.

Born in France, Fabrice grew up in Nice and attended Princeton University where he graduated summa cum laude in 1996. Awarded the Holbert white 72 prize for most distinguished economic students, Fabrice joined McKinsey in New York before flying back to France and cofounding Aucland and building one of the largest auction websites in Europe on the late 1990s. In 2000, Fabrice sold his shares to luxury goods magnate and LVMH CEO, Bernard Arnault.

In 2000, Fabrice returned to the United States and founded Zingy, a mobile media startup making up to $200 million in revenue. In 2004, the Japanese media conglomerate For-Side acquired Zingy for $80 million. He stayed on as CEO for one year.

In 2006, Fabrice and Alex Oxenford launched OLX. Acquired by South African group Naspers in 2010, Fabrice remained CEO until 2013. The largest classified ad website in India, Pakistan, Brazil, Portugal, Poland and Ukraine, the company yielded $800 million in revenue and making $400 million in EBIT.

Ranked as the world’s top seed investor by Forbes, Fabrice and his team analyze more than 100 startups a week and make new investments several times a month. As of 2019, he has funded in over 540 startups with 170 exits including initial public offerings, generating a realized Internal Rate of Return of 68% yearly for the last 21 years.

Today, the largest investor in his fund, Fabrice has deployed $220 million in capital of which $75 million belongs to him.

Fabrice is mainly investing in three subjects including:

- Verticalizing horizontal marketplaces. As an example, Fabrice could look at Craigslist or Le Bon Coin in France and fund a startup that would improve the user experience in that category.

- Emerging B2B marketplaces: much like in the early 00s just before the dotcom bust, we’re seeing numerous B2B marketplaces flourish across many verticals including fish, logistics, steel and much more.

- Reinventing old marketplaces. A marketplace like Upwork is connecting customers with digital talent globally. Yet, according to Fabrice, it could provide more assistance in spotting the best supplier. Assume you need a full-stack developer or a Python expert, Upwork would probably offer over 30 or 40 potential candidates and it would take forever to find a relevant match. Fabrice is helping startups like Comet in France connect top engineers with clients. Comet is looking to curation quality to build its differentiator against Upwork.

Before we get into Fabrice’s take on investment, let’s start out with analyzing and figuring out how the venture capital business works.

I address this matter in a recent conversation with Fabrice. It has to do with a lot of different things including time allocation, business model selection, finding the right place in the funding rounds, and investment heuristics.

First principle on generating superior returns in seed-investments : allocate time wisely

Many VCs are spending their time in low return startups while Fabrice, independent of LPs for capital, is focusing on high return founders

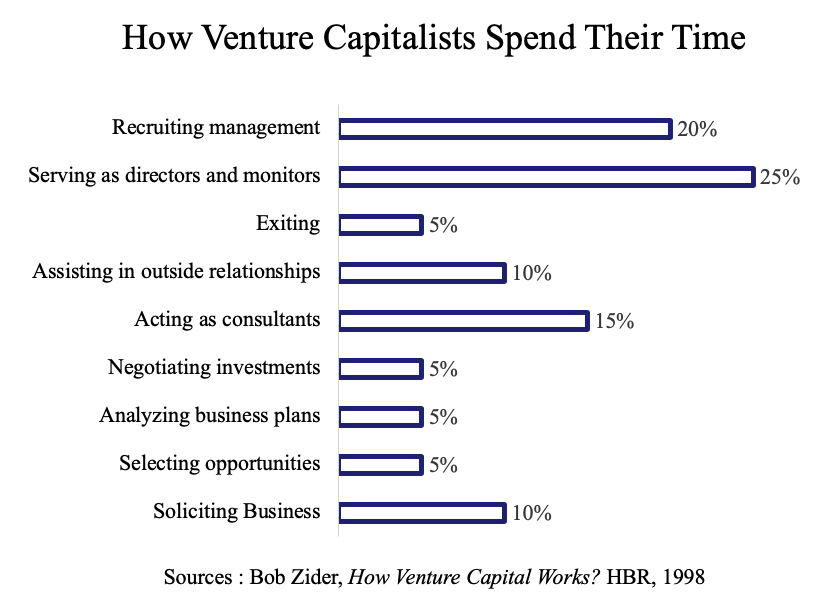

This is how VCs and spend their time, according to Bob Zider of HBR :

According to an article published by HBR in 1995, entitled “How Venture Capital works” investors set aside 45% of their time to helping founders manage operations whether it’s recruiting talents or serving as directors and monitors. Deal flow is taking 10% of their time to review business plans and select opportunities. Although exiting and looking for potential acquirers is critical to making money, their only spending 5% of their time on this crucial matter, as stated by Bob Zider.

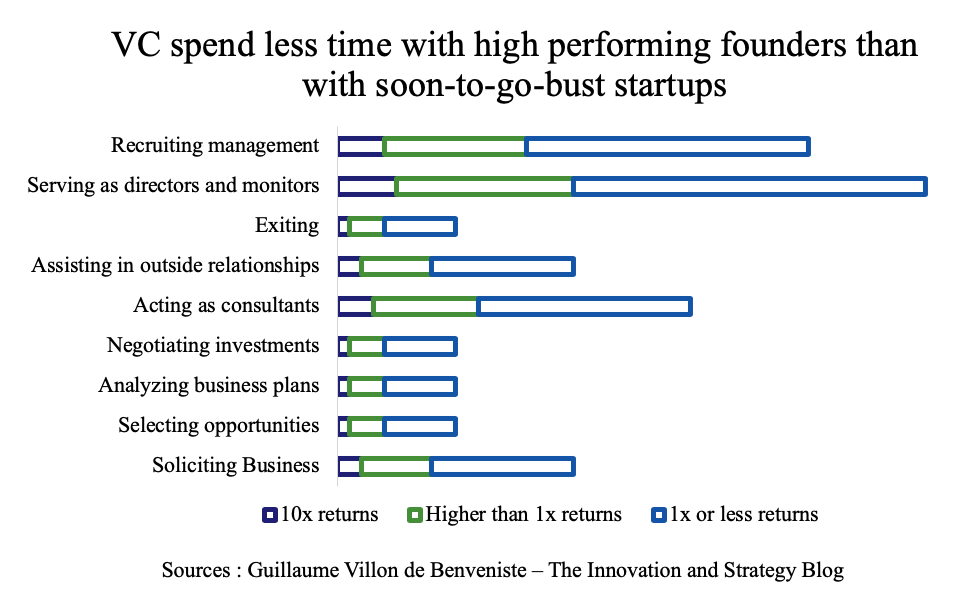

As mentioned previously, venture capitalists play an active role as startup board members. Therefore, combining time allocation with expected returns would get us to the graph below:

What does this graph show? VCs are devoting 10% of their time working on 10x opportunities and 60% on ventures offering disappointing earnings. Efficiency ought to steer VCs in spending more time with high potential companies and less with those that appeared to be stuck. But, as board members, they must endorse advisory responsibilities and play an active role in day-to-day operations in every single startup.

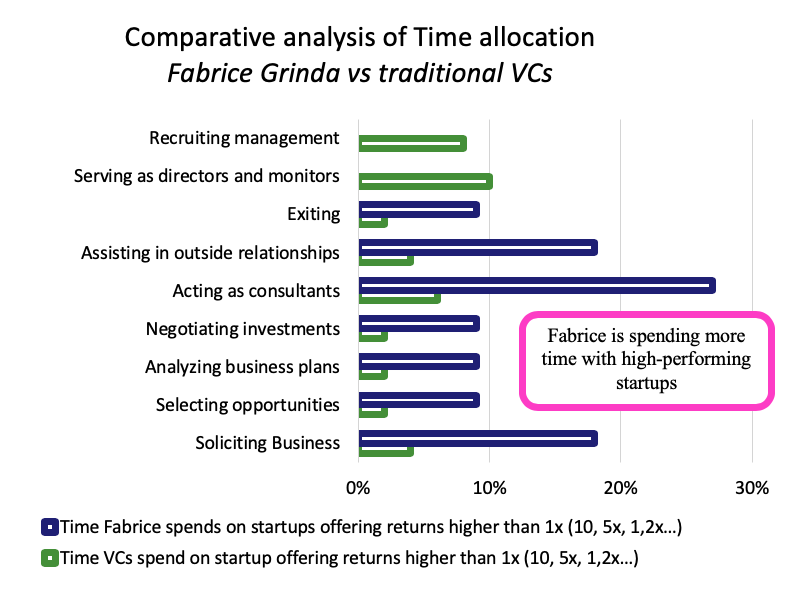

Now let’s compare this with Fabrice’s way to doing business, as shown below:

First, Fabrice is not a board member. Therefore, he’s not playing any role in recruiting or working as a director. He’s clocking more time with high potential organization to maximize returns anywhere from 10x to more as shown below:

Fabrice mentions that “in the early batch of investments where I invested a lot, I typically joined the board, organized regular meetings and was very involved. The reality is that a lot of the time spent in the board meetings and getting reports was not very productive. An email update or a 5-10 minute phone call once in a while is more than enough to get a sense of how the business is doing. Moreover, rather than having structured times to talk, it’s much better to be available punctually whenever the entrepreneur needs help. This works better for me given it takes less absolute time and is better for the entrepreneur because they get the help they need when they need it. I sometimes don’t talk to an entrepreneur for 6 months or more, but then end up spending a lot of time with them discussing a term sheet they might have received if they are fund-raising, etc.”

Second principle on generating superior returns in seed-investments : go for platforms!

While many VC are business model agnostic, Fabrice is only supporting the most profitable business models: platform-based startups.

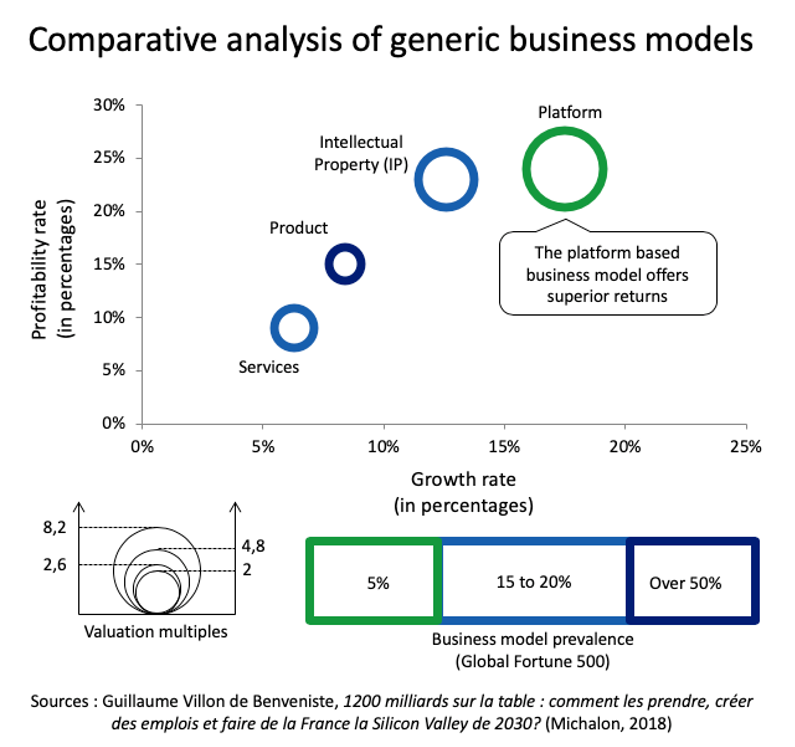

Investors typically choose to back numerous different business models whether it’s building products, delivering services, developing intellectual property or creating marketplaces.

Just a few words to clarify the definition of each business model.

- A product corporation is making tangible goods and selling them at a profit like automobile manufacturers. Most of its costs come from making, designing and distributing the items.

- A service organization is paying high wages to professionals delivering consulting projects or offering legal recommendations. Examples involve McKinsey, BCG, Bain&Co, Accenture and lawyer firms.

- An intellectual property-based company includes biopharmaceuticals or software organizations such as Pfizer, Merck, Adobe. They invest heavily in R&D.

- Finally, platforms extend to Amazon, Google and Facebook connect buyers to sellers through a platform. Free of expensive manufacturing plants, R&D or service professionals costs, production is outsourced to third-party partners. Marketplaces are interacting with multiple sides—the buyer and the seller. Sometimes known as “2 sided businesses,” they differ from, “product-centric” or “service-centric” organization only working with one type of clients.

As shown above, platform-based startups outperform any other business model in terms of profitability, growth rate and shareholder valuation.

In a follow-up post I’ll discuss other investment principles.

[…] post, I discussed how the world’s top seed-investor, the Franco-American Fabrice Grinda is generating superior returns in seed investment. I discussed 2 of his 8 principles, including wise time allocation and going for startups operating […]

[…] wise time allocation […]

[…] 1/ Many VCs are spending their time in low return startups while Fabrice, independent of LPs for capital, is focusing on high return founders […]

[…] advises entrepreneurs only when called on. World-renowned leader turned Business Angel turned VC, Fabrice Grinda is a proponent of the latter […]