Yes, adding capacity is a must, but minimizing risks proves crucial too

Building additional capacity is only addressing part of the issue. The ecosystem here in France would surely benefit from boosting capital efficiency ; that’s the value created per dollar invested. Turning 5 billion euros to 15 billion euros starts with making each dollar count and mitigate risks.

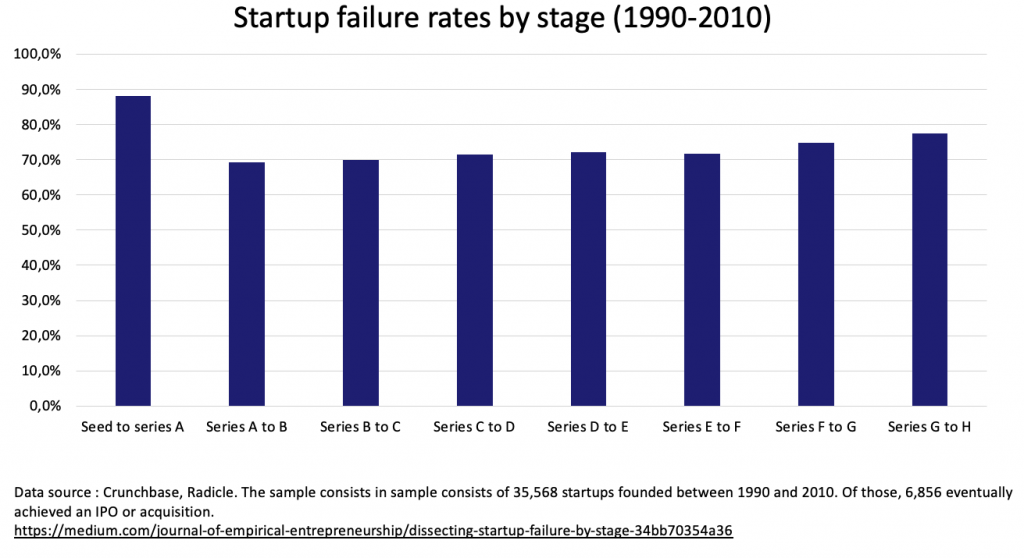

According to Crunchbase and the Journal of Empirical Entrepreneurship, 80.72% of VC-backed startups go bust. Many believe that early stage startups incur most risks. Unfortunately, building a new venture carries risks from seed to late stage series H as shown below:

Therefore, another way of creating more jobs, more R&D and more shareholder value through innovation would be to minimize risks from seed to series H startups.

Turning 5 Billion Euros to 15 starts with looking at why startups go bust

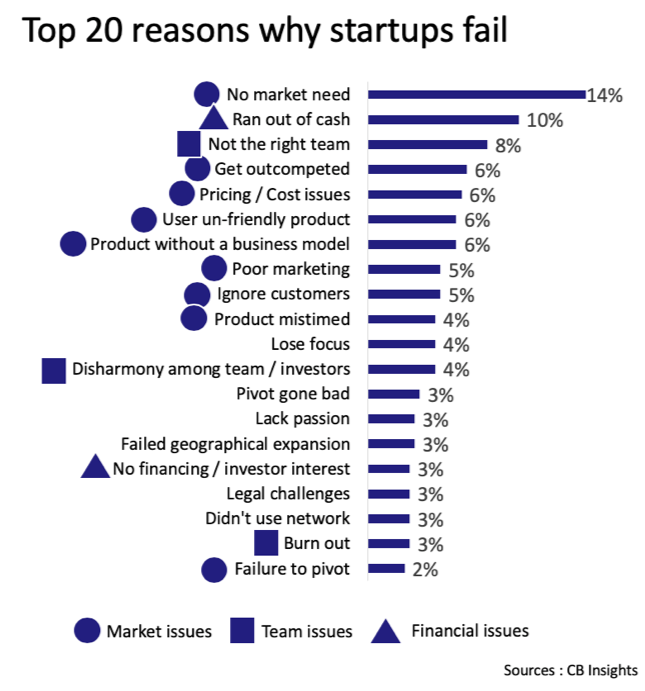

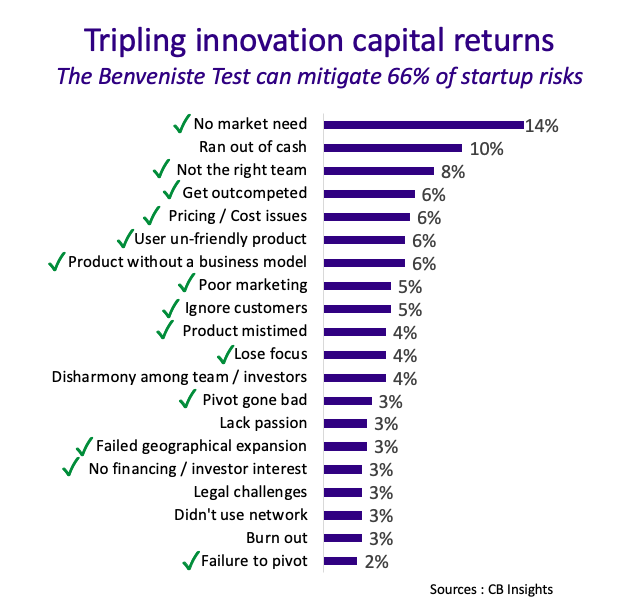

This would require to look at why startups go bust in the first place. According to CB Insights, founders mention the following top 20 reasons explaining bankruptcy.

Failure to understanding clients plays a critical role in startups going bankrupt

It turns out that market misunderstanding plays a key role 60% of the time. More surprisingly: technology is never mentioned as a reason for running out of business.

Why? Because entrepreneurs try their technology out and see whether it performs as expected or not. But testing marketing concepts—often based on intuition, gut feeling and belief—proves much more elusive. In other words, while engineers can examine their products in real-life circumstances, client-facing leaders are only making assumptions.

Yet, client analysis is based on pseudoscience

I’m struck by how different technology meetings are from business development conversations.Let me illustrate with an example. Assume a technology team is putting in hundreds of hours on coding a piece of software. Now comes demo day. Instead of having it perform as expected, a giant blue screen appears with the word “BUG”. 200 people are watching: everyone agrees that “something is going wrong”.

Technology produces objective True of False conclusions : no room for debate

Another group is working on a rocket. They want to test it out too. They prepare for launch. As they press on the “ignite” button, the machine blows up. Again, much like the software demo, all concur that “something doesn’t seem right”.

Technology produces binary conclusions: it performs up to the task or doesn’t. No room for debate. No need to start “consensus building meetings” that drag on forever and never create a common vision.

Instead, the conversation among the 200 software and rocket decision makers examine objective reality: “why did the rocket explode? Why is the software buggy? What’s not working? What should we do differently next time?”

In marketing, anything goes

Now contrast this experience with business development discussions. Assume you’ve put together a great team: they graduated from the most prestigious schools, led global companies and are engaging industry-leading clients. After two years of thorough analysis, they’re sharing their thoughts with an audience of 200. As they present their findings, each and everyone in the room shape their own personal view. At the end of the meeting, there are as many points of view in the room as there are folks listening in.

In other words, while technology teams can agree on whether products work or not, business development groups can’t get to a common vision. To put it differently, technology leads to “yes or no”, “true or false” kind of information while business development generates countless opinions. So, while technology decision makers are looking at solutions to coding software that won’t malfunction or designing rockets that don’t blow up, business development VPs are busy “building consensus”. But, despite what everybody says, they never reach it.

But, what if, we were able to turn our understanding of clients, markets and consumers into a science? Capital returns would triple. Every dollar would deliver three times as much; the number of startups going bust would be divided by three.

Turning 5 Billion Euros to 15 would mean evolving innovation into a science

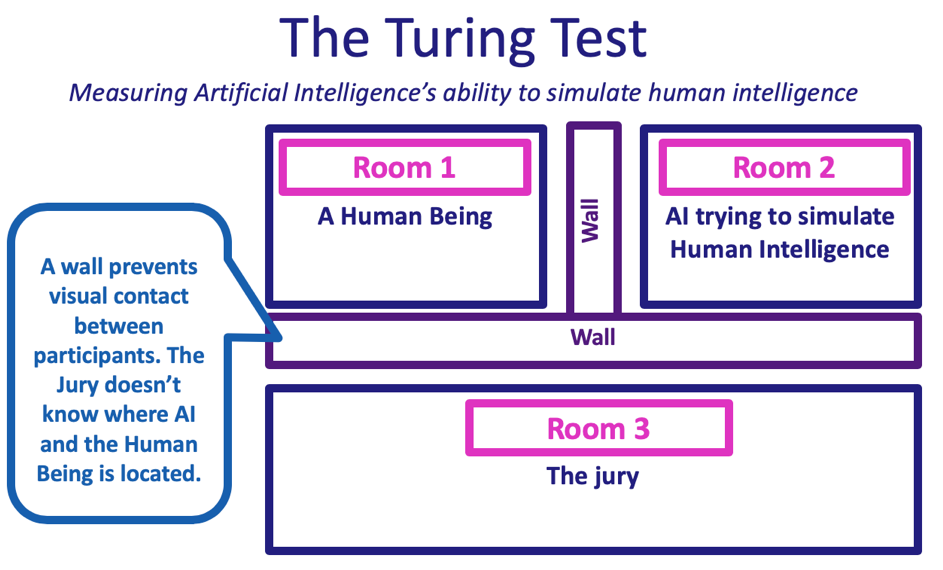

In order to tackle this matter, I started reading a lot of science and one day, I came across the Turing Test. A famous cryptographer who cracked the “Enigma” code the German armed forces used to send messages securely, Alan Turing continued working on his intelligent machine after World War II. He wrote a seminal essay entitled “Computing Machinery and Intelligence,” published in 1950 in the leading philosophy journal Mind. He wondered when it would surpass human capabilities. Now this is typical of a marketing-like question: very open-ended and suggesting deeper considerations such as what’s intelligence and how to measure it?

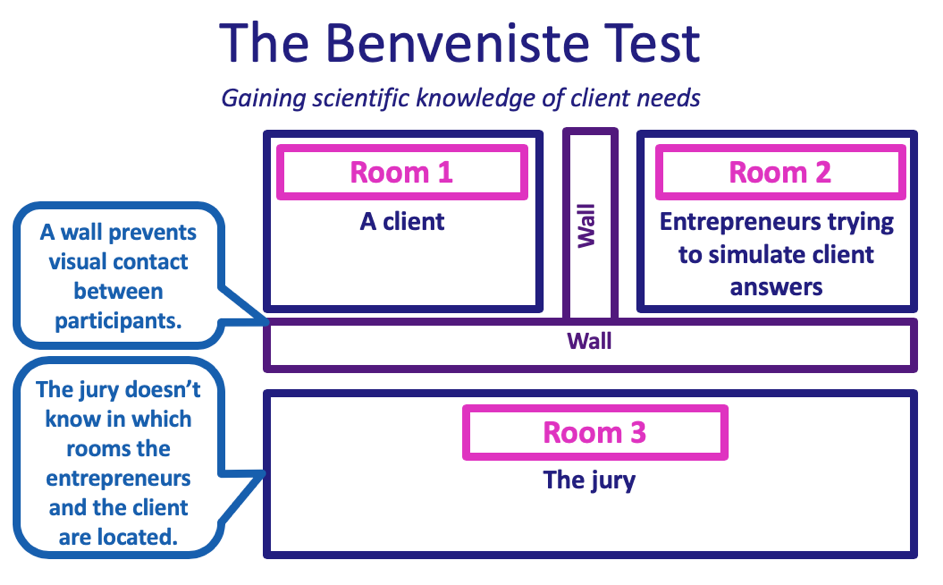

Alan Turing proposed an experiment to evaluate whether his creation could simulate human-like intelligence. He imagined three rooms. In one room, a human being is seated; in another, a computer is trying to imitate human intelligence. A jury is sitting in a third area and doesn’t know who’s where. But they get to ask questions. And based on the answers, they must distinguish Man from Machine.

Let’s look at an example. Assume the jury is asking the following question: “why are we here?”

They get two different answers.

- One reads: “we’re conducting the Turing test and we want to explore whether AI can match human intelligence”.

- Another one states: “we are here because I am programed to be here”.

Based on this input, the jury believes that the first comes from the human being and the second one from the machine. We check to see if these beliefs are correct. And they are! AI is not simulating human thinking to the point of fooling the jury. It failed the test.

This provides a binary input. The jury is either correct or incorrect. The machine either flunks or succeeds. You can’t have it both ways. No room for debate … and consensus building.

The Benveniste Test takes Turing’s idea to innovation.

Tripling innovation capital returns: introducing the Benveniste Test

In the Benveniste test, one would find three rooms. A client is based in the first one. In another, a team of entrepreneurs is looking to embrace the consumer’s ideas and needs. The jury ignores where the client and the startup founders are sitting. All they’re aware of is that they are seated in different places. Plus, they’re informed that entrepreneurs are instructed to capture the spirit of the user and fool the jury. The jury must distinguish both parties by analyzing answers to their question.

I’ve also presented the Benveniste Test at Orange. I showed how to tackle risk supervision and provide scientific evidence of client understanding :

I’ve shown that mitigating 2 thirds of innovations risks could triple capital returns.

With this in mind, I wrote to President Macron with the intention of meeting to discuss the Benveniste Test and explain why it’s a superb efficiency booster. The letter also appears in my book in French.

Turning 5 Billion Euros to 15… great, but how?

The idea is to :

- conduct thorough risk analysis on startups. It turns out most fail because entrepreneurs lack client understanding

- Use the Benveniste Test to test whether founders know their clients. The Benveniste Test can also be applied to other stakeholders including technologists, investors, potential acquirers

Please additional sources here :

Below, President Macron inaugural keynote of this year’s France Digital Day:

Please find below the communiqué coming out of the Ministry of the Economy (in English)

[…] accélérer les startups? Comment soutenir l’accélération des startups au moment où la priorité de l’innovation est passée de la création de startups aux […]