Why has France embarked upon the project of taxing Google, Amazon, Facebook and Apple and devised a tax that is a specific to digital players also known as the GAFA Tax? And why has France decided to go it alone, despite its long-held belief in European cohesion and unity? I addressed this and more with France 24 journalist, Julia Sieger.

I/ Why is there a GAFA Tax in the first place?

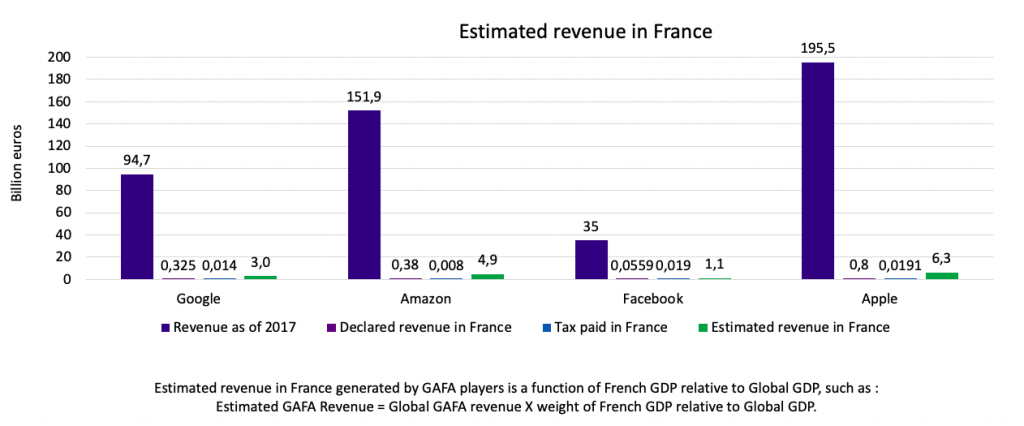

There are several ways of answering this question the most obvious one begins with the idea of that similar companies are paying higher taxes. Whereas retail giant, Carrefour, is subject to over 83 taxes according to its CEO, Alexandre Bompard, many digital players including Google, Amazon, Facebook, Apple as well as other non-US companies such as Criteo, seemed to be getting away with much lower tax rates will below 1% of their revenue in a country where corporate taxes stand at 23%.

II/ A changing social mood

Also, it turns out that a drastic change in the social mood in France, embodied by the yellow vest movement, has led scratch that is leading French policy decision makers to exploring ways of increasing public service while decreasing taxes to French citizens. So policymakers are seeking new sources of fiscal revenue. And considering that digital companies are paying low tax rates on their profits, that seems to be an obvious place to look at more closely. The GAFA Tax should generate 500 million euros on a yearly basis.

III/ Onboarding the European Union proved more challenging than expected

French economic minister, Bruno Le Maire, has traveled Europe many times to onboard the European Union. But his idea was met with much skepticism especially in Sweden and Germany both fearing fiscal retaliation from the United States.

IV/ Why the GAFA Tax?

The deeper reason behind this GAFA Tax has to do with the new kind of economy that we’re building today. While nations and the European Union, are setting borders in land, sea and air to organize production, property, and fiscal policy, it turns out that digital technology appears ubiquitous, as is a could do away with national borders. This is a profound change in the way we think of space, time and carries direct implications for taxation. Western countries came out with their fiscal, economic and social policies during the Second Industrial Revolution. But digital technology is leading decision makers to set borders in the digital world, in addition to those that already exist in land, sea and air.

Europe stills needs to prove it can prosper in the digital economy.

No comment