Which applications stand out as the most thought-provoking? Where should we put our money if we want to generate over 15 Bn in revenue in 2025? How do they utilize fresh technologies in order to solve real economic problems reaping profit? I address some of these questions below, as they appear important to many including:

- Experts looking for evidence that technical know-how delivers monetary value,

- Economists trying to build novel business models,

- Financial analysts creating new services in an industry burdened by heavy regulations,

- People like you and me curious about how the future will play out.

Making a long story short

When this series of articles started out, I showed that digital technologies should size up to a 1.2 trillion dollar opportunity generating 6 trillion dollars for shareholders. Value creation lies in 7 technologies, across 10 industries. Optimizing existing business and developing novel products prove critical to capturing 1.2 trillion dollars. Finance—one of the top 10 sectors—should claim 108 Bn thanks to 8 use cases. Today, we’ll direct our attention to 2 of them in more detail.

Compliance cost reductions to save $2 Bn

An evolving regulatory environment means higher costs

With the outbreak of the 2007–2008 meltdown, the Obama administration and the European Union implemented a series of opportune regulatory policies to minimize the risk of an additional breakdown. In the United States, Congress called for greater transparency and automatic financial data exchanges between countries. Rules have grown exponentially. Currently, clients wanting to open an account in a private bank must sift through over 1000 pages of legal paperwork:

- JP Morgan has seen its compliance cost rise to approximately $9 billion by 2014,

- Citigroup is allocating 30% of its total headcount to compliance activities.

Associated costs add up to $14 billion in the top 10 investment banks while community players (with assets less than $10 billion) have to spend a cumulated $4 billion.

Failing at compliance comes at a heavy price

Banks have paid heavy fines to US regulators:

- BNP paid $8.9 Bn

- HSBC: $1.9 Bn

- Standard Chartered: $667M

- ING: $619M

- Crédit Suisse : $536M

- ABN-AMRO: $500M

- Barclays: $298M

- Clearstream: $152M

- RBS: $100M

- P.Morgan: $88,3M

What AI can do to lower compliance costs

Artificial intelligence is streamlining compliance checks as algorithms turn out up to be much faster at verifying newly enforced regulation than human operators. Digital reasoning, a Nashville-based startup, has developed a novel approach to managing the compliance process. Machine learning techniques “provide proactive compliance analytics, completing tasks such as sifting through employee emails for potentially noncompliant content and detecting violations such as market manipulation, unauthorized trading or wall cross violation”, according to a Goldman Sachs’ report on Artificial Intelligence.

All in all, compliance costs reductions reach $2 billion.

Asset management optimization to reduce costs by $14Bn

Asset management optimization stands as another thought-provoking use case.

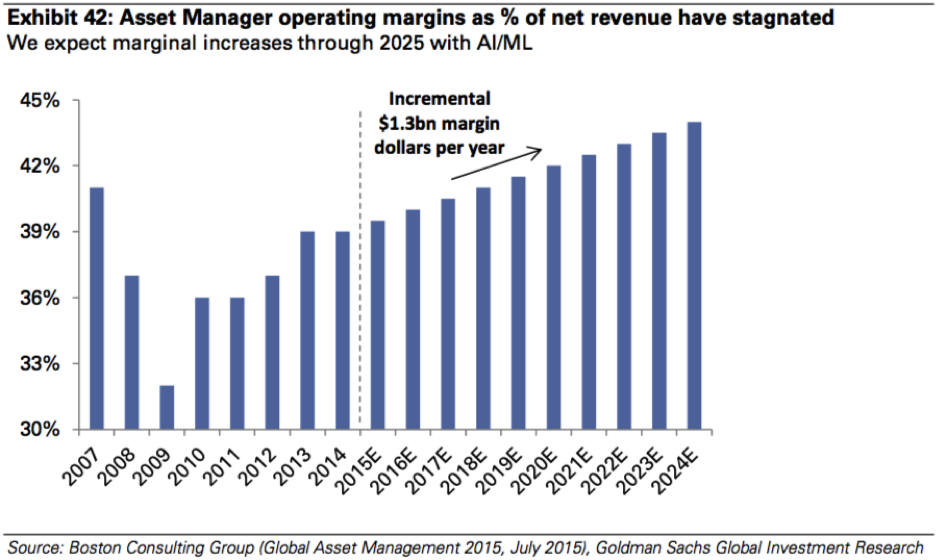

Since 2007, operating margins as a percentage of net revenue has declined from 41% to 39%.

However, space-sourced big data offers new ways to read the global economy both in terms of production output and domestic demand. Orbital Insights, a Californian startup, is developing an algorithm that scrubs pictures taken from satellites and identifies meaningful trends.

For example, Artificial Intelligence assess whether consumers are flocking to a specific retail store based on the number of cars in its parking lot. If they turn out in substantial figures over an extended period of time, analysts anticipate stock market price increases in the near future.

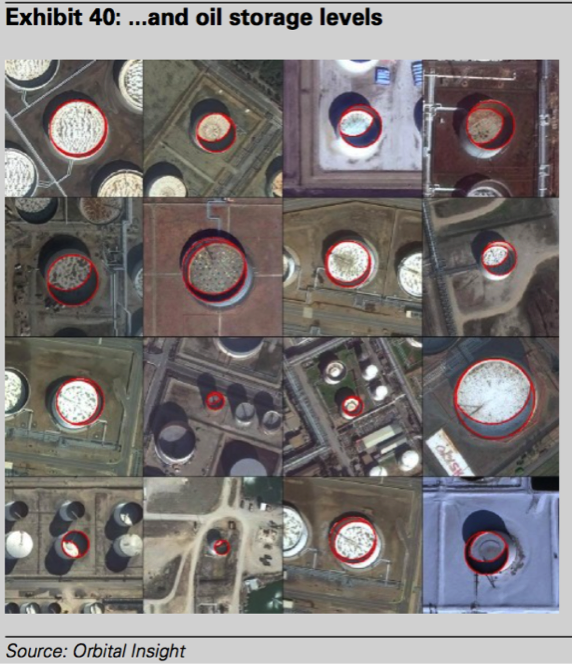

Also, oil prices depend on availability and demand. Orbital Insights sizes up storage levels by scrubbing images, as indicated below:

If storage appears low, then prices may go up, all other things being equal. Alternatively, if oil storage increases, prices drop.

In the near future, nano satellites out of Planet Labs, a California-based startup, should provide a global picture of our planet’s economic activity by measuring output while assessing demand simultaneously. This should help decision makers to utilize their facilities in the most timely fashion. When production exceeds demand, supply is decreased. Conversely, when supply outstrips output, plan managers expand capacity.

All in all, cost reduction adds up to $14 billion.

To sum up:

- Artificial Intelligence applied to compliance checks may lead to a $2 Bn cost-saving opportunity

- Improving asset management could lower operating costs by $14 Bn.

[…] addition, I focus on the financial industry and show that eight use cases should generate approximately $108 billion by […]

[…] Du côté des startups, une évolution est également nécessaire. Beaucoup, à l’image de Planet Labs (dont le nom est désormais Planet), sont arrivés sur le marché spatial en pensant qu’ils […]