Compensating CEOs based on their ability to lead corporate innovation poses a broader of how we measure financial performance.

I/ Sustaining innovation is job neutral and offers interesting investment opportunities

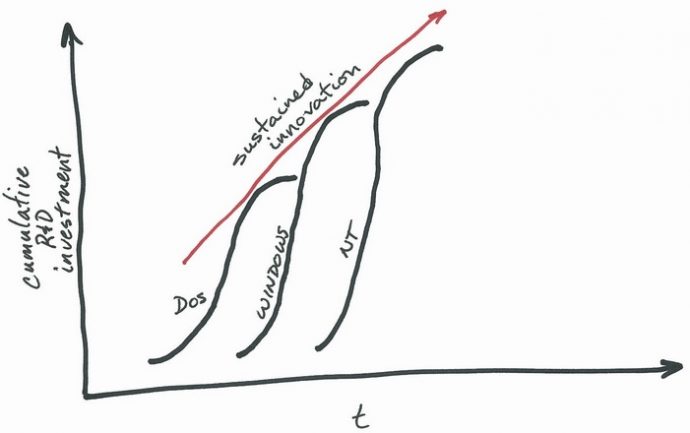

Sustaining innovations

Where “DOS”, “Windows” and “NT” refer to MS’s various operating systems

The third and final kind of innovation is a sustaining innovation. This kind of innovation is defined as an innovation that helps an existing company penetrate a new market segment, by making good products better. For example, automobile manufacturers develop a new kind of car which is aimed at the high-end market.

When Japanese car manufacturers penetrated the US market, they penetrated the low end market segment.

- Then, as time passed, they penetrated higher market segments.

- Today, they have successfully penetrated high-end market segments with the Lexus.

Every time Toyota sells a Camry, it doesn’t sell a Lexus. So, these kinds of innovations have a neutral effect on job creation. They require that a company develops new skill internally to penetrate these high-end market segments, but they don’t really require that the company hire more.

II/ Financial analysts choose efficiency innovations over other kinds of innovation for rational reasons

So this really shows that each kind of innovation has a different impact on job creation. But what this also shows is that financial analysts will invest primarily in efficiency innovations at the expense of sustaining and disruptive innovation. And if financial analysts choose to do so, it is because the way we measure financial success today leads some to choose efficiency innovations over other kind of innovations. If we want to create an economy that creates more growth, then, we need to change the way we measure financial performance. If we keep rewarding short-term performance then, we will continue to finance efficiency innovations which are detrimental to job growth.

The same is true with CEO compensation. If we keep rewarding shareholder value over the ability to manage for disruptive innovation, then we will continue to see CEOs manage for operational excellence rather than innovation. So the key to more innovation is not so much to change the way we pay CEOs; the key to more innovation lies in the way we measure financial performance. Putting innovation at the heart of a company’s strategy means changing the way we assess financial performance.

III/ The example of Maurice Lévy shows that an innovation-driven CEO who’s paid according to his ability to innovation may cause controversy

Courtesy of L’Express

Stéphane Coumau mentioned that he was really surprised that, in France, there’s controversy on Maurice Lévy’s differed bonus, the CEO of Publicis, the world’s third largest communications group.

- In 1996, when Maurice Lévy became CEO, the company’s sales were 560 million Euros and profit was 23 million Euros

- In 2001, Publicis’ sales rose to 5,8 billion Euros, while profit rose to 600 million Euros

IV/ What if CEO compensation was innovation-based?

Most of this growth is due the disruptive innovation in online communications. As a consequence, the company created 48 000 new jobs. And yet, despite these stellar results, there has been controversy on Levy’s 16 million Euro differed bonus:

- Valérie Pécresse, former budget minister, called his bonus “excessive”

- Nicolas Sarkozy, former President of France, called his bonus “shocking”

- François Baroin, former minister of the Economy, called the bonus “justified”

To sum up, tying in CEO compensation to innovation poses the question of how we measure financial performance. Today, we reward low risks and short-term financial returns. This may sound logical, but, if we continue to reward low risk and short-term investment, then CEOs will continue to manage for operational excellence (also referred to as “efficiency innovation”), to the expense of disruptive innovation. So, making innovation the heart of corporate strategy implies that we change the way we measure financial performance.

What are your thoughts? How would you tie in innovation performance to CEO compensation?

Further readings

No comment