In previous post, showed that Fabrice Grinda is generating handsome returns for several reasons :

- wise time allocation

- going for a high potential business model

- efficient risk mitigation

- unit economics

Today, I’m going to look at a few other principles.

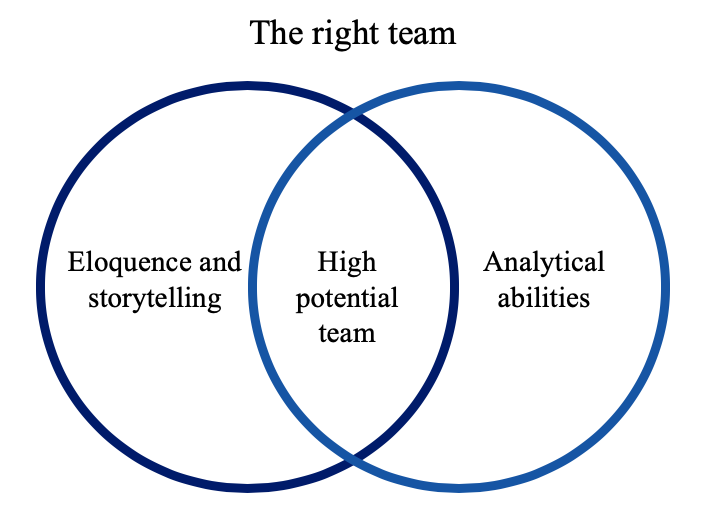

Sixth principle to securing handsome returns : Fabrice is assessing a team’s relevance based on 2 distinct abilities

1/ Do we like the team?

Fabrice believes that it’s a function of eloquence because gifted storytellers know how to engage with an audience, hire talent, convince investors, get press and initiate partnerships.

This ties in pretty nicely with Jeffrey Bussgang’s views. In his book Mastering the VC game (Penguin, 2011), Jeffrey writes: “As a kid, when listening to my parents discuss the work of my father’s company, I was surprised that they talked mostly about people and relationships rather than technology and money. How could the vice president of engineering communicate better with the vice president of marketing? Is the technical team getting along with as well as they should on the new project? It was then that I learned the centrality of human relations in business, a theme that has guided my career and a theme that plays out over and over again in this book in the stories of the entrepreneurs and VCs that I interviewed.”

2/ The second criteria involves analytical abilities

Do founders understand business modeling, customer acquisition costs, profitability, cost structure and pricing? It turns out that the Venn diagram between storytellers and analytical minds is slim such that most entrepreneurs fail to meet both criteria.

Seventh principle to generating handsome returns : looking for a reasonable valuation

It is the valuation reasonable considering the opportunity, capital needs and the startups maturity level given valuations in the American venture capital landscape.

- Pre-Seed is about $1 million and $3 to $5 million pre-money. The seed financing round startup is generating $150K a month. Seed investors are taking between 15 to 20%. Startup founders are raising 3 to 8 million pre-money.

- A series A is a company making $650K a month and raising between 7 to 18 million pre-money.

- In a series B, the company is making 2.5 million a month and raising between 20 to 50 million pre-money. The startup must be somewhere in this range with limited variations.

If these criteria are met, then Fabrice will fund the startup. Fabrice takes a decision in one hour or less.

Fabrice shares his deal flow with other VCs: many leading venture capitalists like a16Z, Greylock to have Fabrice on board so that they can get his expert opinion on marketplace startups.

Finally, Fabrice exits when demand for promising startup shares is high

Fabrice only acquires limited shares of the startup’s capital—anywhere between 3 to 5%. Selling his shares doesn’t send mixed signals on the company’s performance as opposed to traditional venture capitalists, owning up to 20 to 25% of a startup. Fabrice enjoys the possibility of selling his shares when the time seems right.

Why doesn’t Fabrice get competed out?

As indicated above Venture Capitalists get their money from Limited Partners. Limited Partners believe in running the investment business according to guidelines. When they learn that Fabrice doesn’t conduct a thorough due diligence, will invest in any geography around the world, they decline to invest in Fabrice’s funds despite its superior returns.

So… how to generate superior returns? Going for the right team (boasting analytical and soft skills), reasonable valuation and exiting at the right time proves crucial in making handsome returns.

Next week, I’ll summarize Fabrice’s advice on the seed investment strategy.

[…] could investors reduce risks and ensure profitability? How could they get a clear understanding of future revenue? Founder of Airbtics, Jae Seok An […]