VCs are in risky business as mentioned in a recent article where I talked about how the Venture Capital business operates. Yet the world’s top seed investor, Fabrice Grinda is developing a systemic approach to generating a steady 68% realized Internet Rate of Return. I’ll talk about my conversation with Fabrice in an upcoming article. In this article, I’ll talk about how VCs create value.

How venture capitalists make money

As mentioned earlier, venture capital, appears riskier than private equity. Founders and investors are looking to make a novel offering, still in search of the product market fit and the client’s purchasing decision-making. Private equity, on the other hand, is focusing on improving a functional business model by expanding its activities: new product launches, novel geographies, build-up…

I’ve sketched out below how VCs create value:

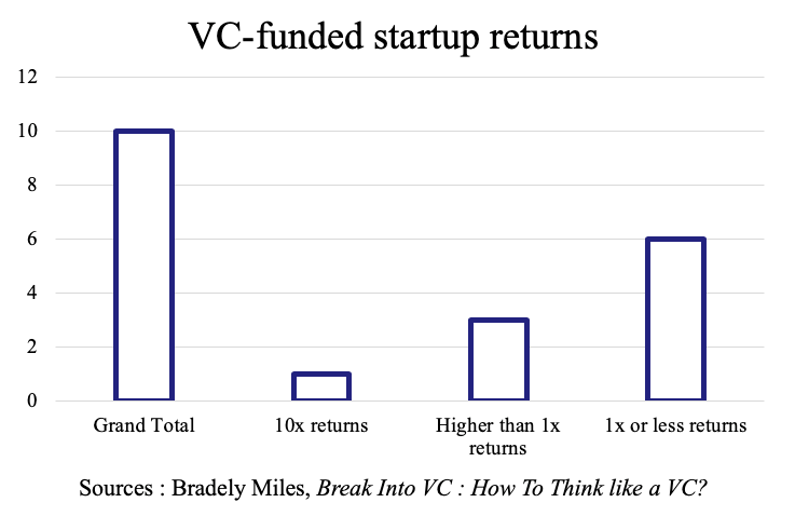

Assume that investors would select 10 startups. They typically would need to secure a 10x return in one startup. If they invested $100,000, they would have to get $1 million back five or seven years down the line.

However, for every high-performing startup, several others are making returns anywhere between 3X to 5X. Finally, five or six startups fail to return the cash they received. So VCs are generating earnings by exchanging shares from portfolio startups. When startups are successful, investors make money; otherwise, they don’t.

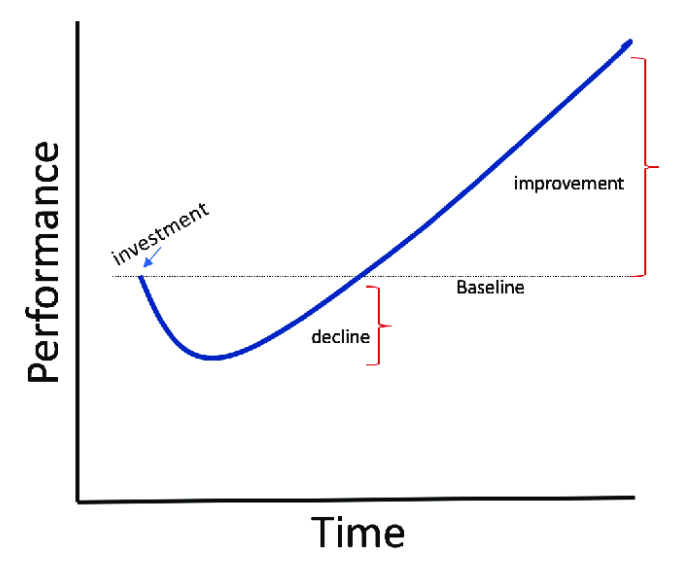

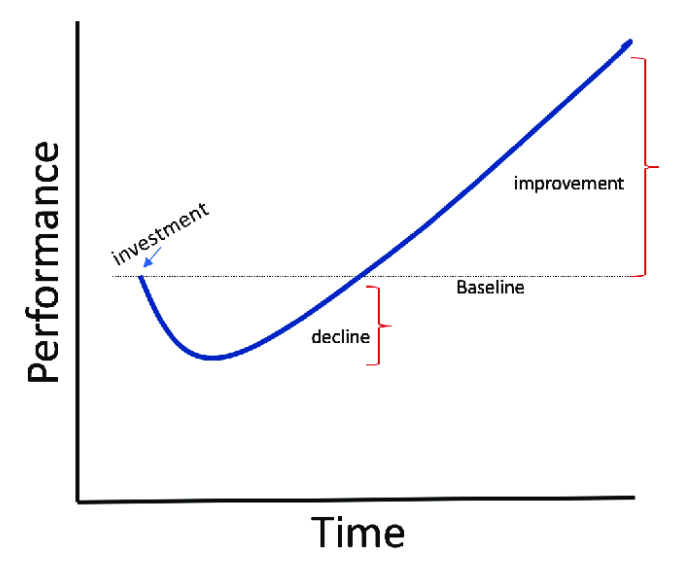

The J curve represents, only figuratively, how VCs create value

Many VCs refer to a J curve to best explains returns.

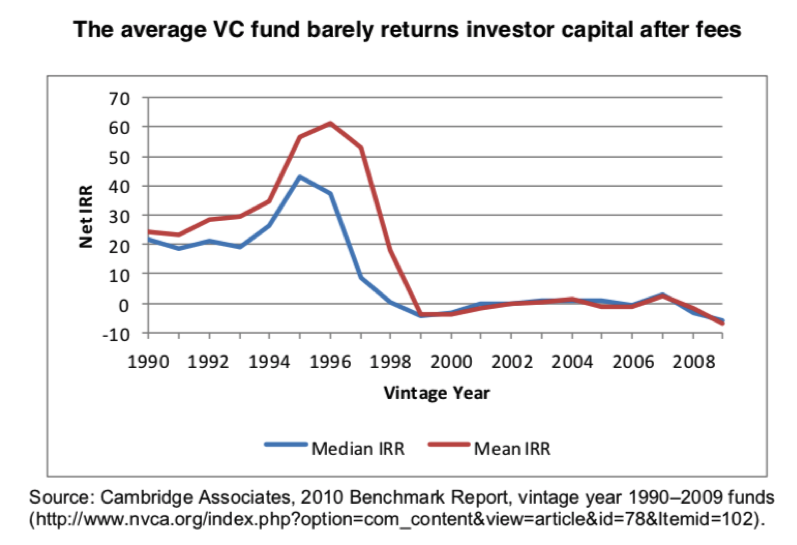

As shown in the graph above, funds generate losses in the beginning before turning to profits later in the fund’s life. But, according to Private Equity advisor for the Edwing Marion Kauffman Foundation and author of the Kauffman Foundation’s report, “We Have Met the Enemy … and He is Us”, Diane Mulcahy, most of VCs fail to return investor capital.

From 1990 to 1998, VCs made an IRR higher than 0. They returned more capital than they raised from their LPs. However, from 1999 to 2001, VCs were seeing a negative IRR and lost capital. Then from 2002 from 2007, they hardly returned LP capital. Finally, during the 2008 and 2009 crash, they generated negative IRR.

And yet, as mentioned earlier, Fabrice is reaching a stable 68% return since 2009. How does Fabrice secure such high returns when many investors barely make any earnings at all? I’ll tackle this question later but let’s look at the VC’s contribution to the US economy, touch upon a recent development in VC space before zooming into to Fabrice’s stellar performance.

VC-created wealth is America’s greatest export

Jeffrey Bussgang, Mastering the VC game (Penguin, 2012): “After decades spent perfecting the VC recipe and passing it on from generation to generation of VCs” VC are exporting their model beyond globally: “In the last ten years, VCs from Silicon Valley and Boston have jumped on airplanes and traveled throughout Europe, Asia, the Middle East, and beyond to instill their brand of entrepreneurship, sponsoring venture capital funds in these regions and exporting their company-building lessons and disciplines.”

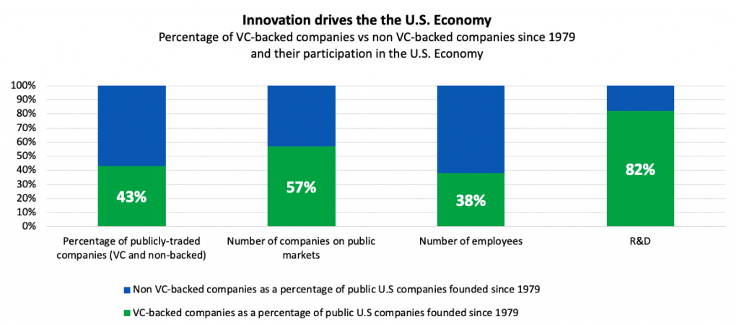

VCs create value but funding startups that generating much wealth in the American economy

According to Standford professor, IlyaA. Strebulaev and Assistant Professor of Finance at Sauder School of Business UBC, Will Gornall, VC-backed companies are bolstering the US Economy in terms of jobs, R&D and shareholder value creation:

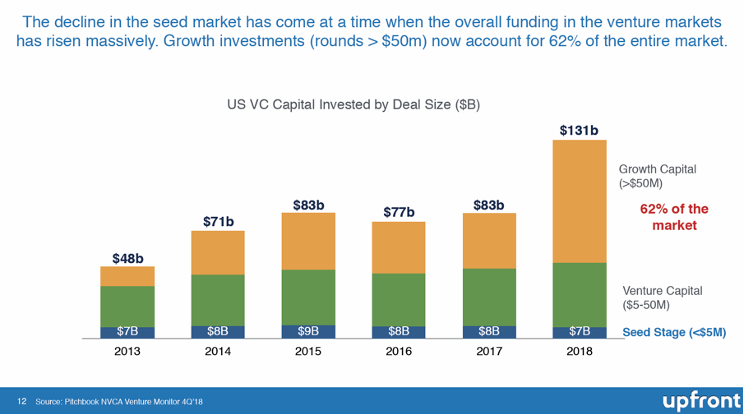

Recent developments: seed funding is cooling off

According to Mark Suster and Chang Xu, seed investments are down by any measure (funds, deals, dollars) over the past 3 years in deals < $1 million AND in deals between $1–5 million.

To put it differently, it looks like most investors are moving down the funding rounds.

For seed investing to continue to boom one of the following would have to happen, according to Mark Suster:

- Series A and / or Series B investing would need to grow commensurately to provide capital to seed-funded startups

- Seed deals would need to become profitable and/or less risky

- Seed deals would need to bypass Series A and Series B investments and go straight to growth rounds or IPOs

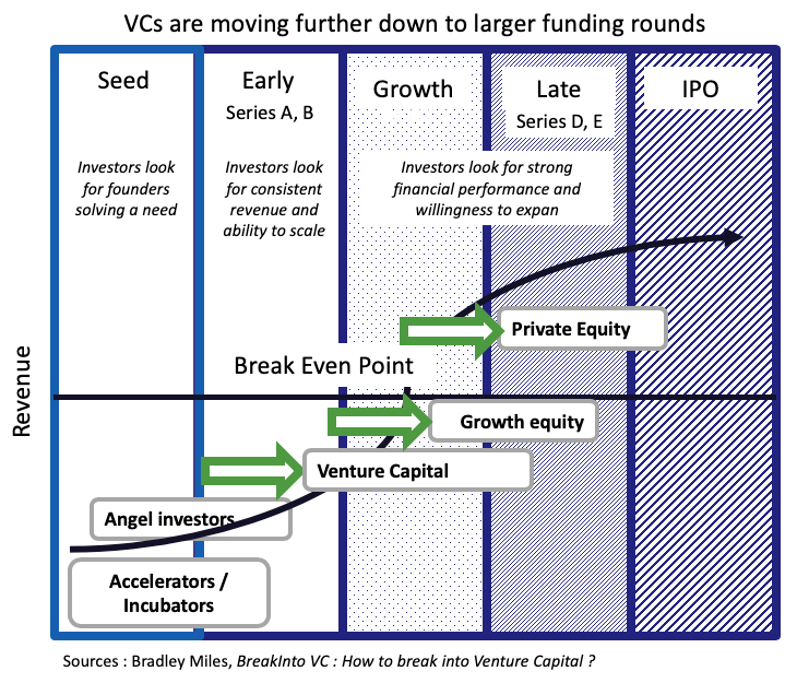

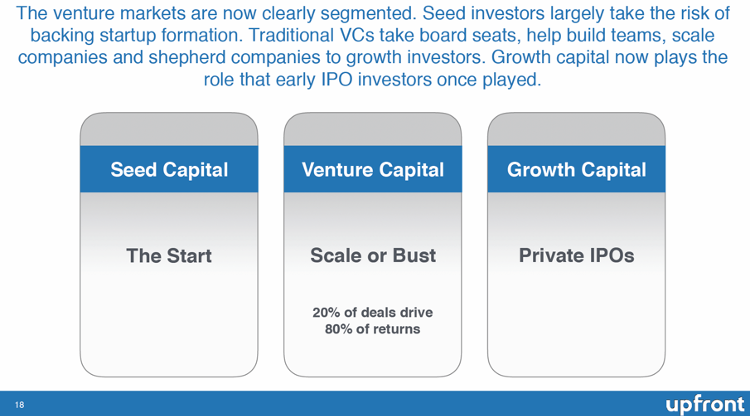

None of this has happened. As a consequence, the funding rounds are becoming more segmented. According to Mark Suster:

- seed investing will remain its own category, focusing on backing the very beginnings of a startup’s life

- series A and B are helping companies get to product/market fit and generate consistent revenues and

- growth capital is centering on Initial Public Offerings (IPO).

To wrap up, VCs create value:

- The Venture Capital industry gets its capital from Limited Partners (retirement funds, governments and established corporations) and invests its funds in promising startup through multiple fundings rounds. Leveraging their relationships with C-level Global 2000 leaders and investment bankers, VCs help startup founders exit via an acquisition or an Initial Public Offering (IPO).

- The funding rounds go from the seed stage where entrepreneur are developing a promising idea to innovative business generating constant revenues and finish with going public.

- Venture Capitalists earn capital when they sell their startups shares at a higher price than the purchasing price. A mark up is achieved when startups reach their grow targets and surpass valuations.

- Although the well-know J curve leads many to believe that VCs generate exponential returns, most Venture Capitalists fail to return the capital they receive from their Limited Partners.

- The VC industry is boosting the American economy and may well be America’s greatest export. But, while series A, B and late stage are growing, seed investment is cooling off.

So this presents an overview of VC create value. In a follow-up article, I’ll touch upon my conversation with the world’s top seed investor, Fabrice Grinda.

[…] In a follow-up article, I’ll look at how venture capitalists create value. […]

[…] a previous post, I discussed how Venture Capital creates value. The Venture Capital business consists in investing in money-losing companies offering superior […]