How does the Venture Capital Business operate?

Most would agree that innovation investments come with high risks especially compared other asset classes like real estate and publicly traded indexes. Yet, in a recent conversation with the world’s top seed investor, Fabrice Grinda, I learned of his systemic approach generating a steady 68% realized Internet Rate of Return across 540 deals since 2009. I’ll get into the details of my discussions with Fabrice in forthcoming articles. In this article, I want to start out by providing an overview of the Venture Capital business, drawing from many sources, including :

- VC expert at Harvard Business Review, Bob Zider,

- author of Break Into Venture Capital, Bradley Miles,

- former entrepreneur turned VC at Flybridget and author of Entering StartUp Land and Mastering the VC Game (Penguin, 2011), Jeff Bussgang,

- author of The Gig Economy (Amacom, 2016) and Private Equity and VC investor at Kauffman Institute Diane Mulcahy and,

- 2x entrepreneur and General Partner at Upfront VC, Mark Suster.

Top row (from right to left) : Mark Suster, Fabrice Grinda

Middle row (from right to left): Jeff Bussgang, Diane Mulcahy

Bottom row (from right to left) : Bob Zider, Bradley Miles Bob

Understanding how investors operate

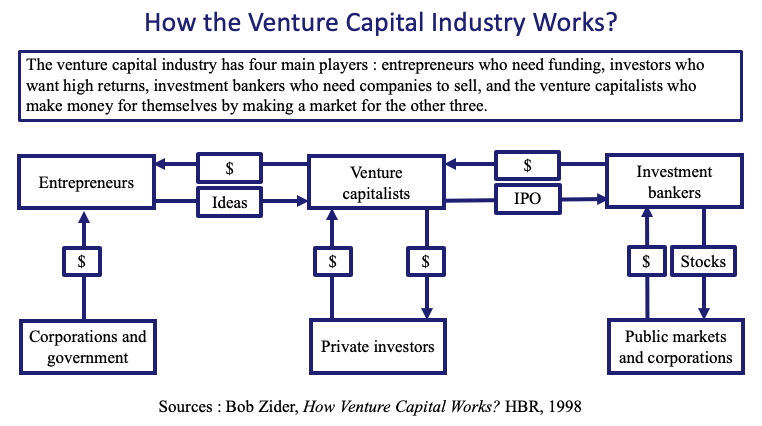

Corporations and government aim to bolster their innovation capabilities. Established companies diversify their revenue sources while policy-makers strive to build a prosperous economy, create jobs and secure technological preeminence in a competitive geopolitical context. When the Soviet Union flew Sputnik in space, American leaders reacted by boosting telecommunications, launching rockets and microchip research to gain ascendancy in world affairs. Federal capital supported Silicon Valley ventures, enabling VC to finance daring entrepreneurs.

Raising funds from private investors, retirement funds, Venture Capitalists spend the first few years looking for opportunities and the last few years exiting. When VCs have grown a company to a mature business, they team up with investment bankers to explore potential acquisitions or going for the public market (IPO).

In charge of trading stocks and finding acquisition targets for large organizations, investment bankers buy VC-backed startups and provide liquidity to VCs and offer IPO advisory.

So this presents an overview how the Venture Capital Business operates.

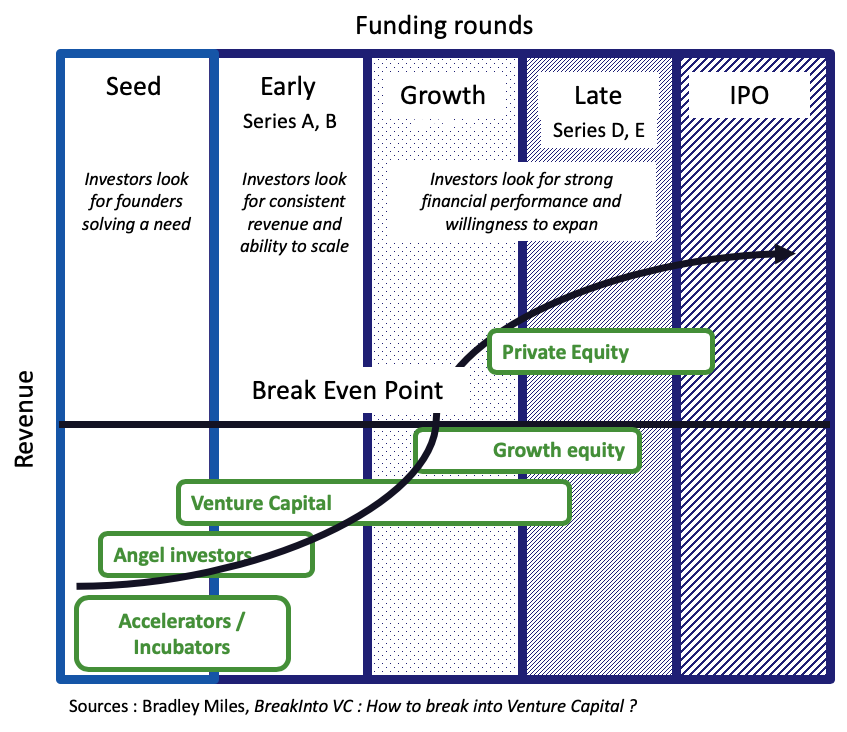

The Venture Capital Business deploys its capital in numerous funding rounds

Now let’s look at the funding rounds from an entrepreneur’s perspective:

Basically, newly formed companies can turn to financing from beginning to end.

Pre-seed

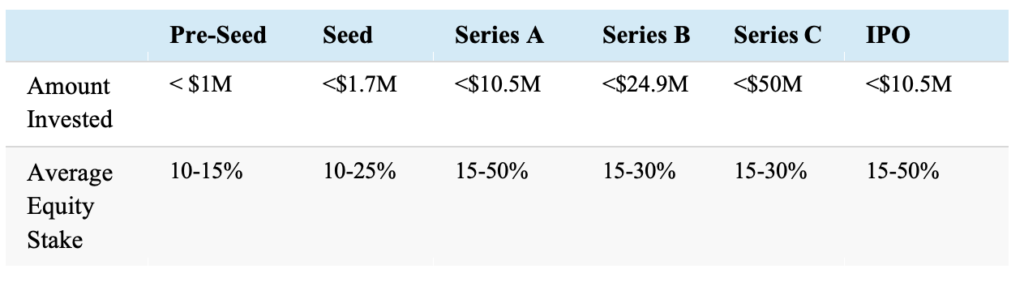

In the pre-seed funding round, founders pitch their business idea to potential investors. These include friends, family, angel investors, or pre-seed venture capital firms. Since performance data and positive financials have yet to be shown, prospective investors must focus on two primary features: the strength of the idea and the team. At this stage, the level of risk and expected payoff culminate to their highest point.

Seed funding: series A to C

After the initial stages, seed funding—the first official funding round—takes place. Entrepreneurs allocate newly received capital for market testing, product development, and bringing operations up to speed. By this point, investors are looking for the company’s ability to solve a need and achieve product-market fit. At this stage, traction and consumer adoption is starting out with clues user or revenue growth. The level of risk remains high here, so investors tend to be angel investors or venture capitalists.

In each series funding, the startup raises more money and increases their valuation. Here’s what investors gravitate towards the following in each round:

- Series A: Companies that not only work on a great idea, but a strategy for creating long-term profit.

- Series B: Companies generating consistent revenue that must scale to meet growing demand.

- Series C (and beyond): Companies with strong financial performance that are looking to expand to new markets, develop fresh products, buy out businesses, or prepare for an Initial Public Offering (IPO).

Private equity firms and investment bankers are attracted to series C funding as risks seem lower. In recent years, startups have been staying private longer. For example, Uber obtained Series G funding and debt financing before going public.

The Venture Capital Business secures returns through Initial Public Offering and acquisitions

Once a company is large and stable enough, it may choose to go public. An investment bank will commit to selling a certain number of shares for a given amount of money.

If the IPO works out as expected, investors will profit and the company’s reputation gets a boost—but if it doesn’t, investors lose money and the organization’s image takes a hit.

Here’s a generic presentation of each stage:

Dilution awaits already onboarded investors as new ones come in, but their “piece of the pie” usually becomes more valuable.”

This is a generic overview of how the financing cycle works. Obviously, many organizations find their own way as they grow. Amazon, reached profitability in 2005, 11 years after its inception in 1994 and 8 years after its IPO in May of 1997.

In a follow-up article, I’ll look at how venture capitalists create value.

[…] article Introducing the Venture Capital Business est apparu en premier sur The Innovation and Strategy […]

[…] VCs are in risky business. Yet the world’s top seed investor, Fabrice Grinda is developing a systemic approach to generating a steady 68% realized Internet Rate of Return. I’ll talk about my conversation with Fabrice in an upcoming article. In this article, I’ll talk about how VCs create value. […]

[…] could investors reduce risks and ensure profitability? How could they get a clear understanding of future revenue? […]

[…] Fabrice is following an investment philosophy much different from most Venture Capitalists: […]

It’s a great source of knowledge; I think it will be helpful for lot of people who are looking for introducing the venture capital business. Thank you very much for sharing this article, this is really helpful for me, thanks again and looking for more in future!!

[…] the innovation ecosystem, venture capitalist stand apart. A source of money and ideas, entrepreneurs seek their advice and capital while industry leaders […]

[…] is key to being able to do Step 2 well. Resources: How Venture Capitalists Make Decisions | Introducing the VC Business | VC Glossary of […]