A few weeks ago Jeff Bezos, Amazon’s founder announced a 10 billion dollar investment fund geared towards transitioning our economy into a greener one. But, how does 10 billion dollars measure up to capital needs required to building a green economy? What could Amazon bring to the green transition? And finally, is there any kind of contradiction between Amazon current operating model and building a green economy?

I/ 10 billion dollars in a green fund : a huge contribution and… a drop in the ocean, at the same time

So what’s 10 billion dollars? Jeff Bezos’ current assets stand at 130 billion dollars. So, 10 billion dollars accounts for 8% of his assets. One would think that it’s actually a small amount. But, how many of us could claim that they’re putting 8% of their assets in the green economy? I know I can’t!

Also, the French venture capital world is putting 6 billion euros in startups on an annual basis. Jeff Bezos investment is actually more than the combined venture capital money available in all France as of 2019. In this respect, 10 billion dollars is a significant contribution.

But at the same time, many experts say that succeeding at the Green transition requires 32 000 billion dollars on an annual basis. Considering the global gross domestic product stands at $80 000, that’s about 40% of global output.

Now, what’s 10 billion dollars relative to 32 000 billion dollars? Not that much…

II/ Bringing the long-term view and customer centricity in a green fund

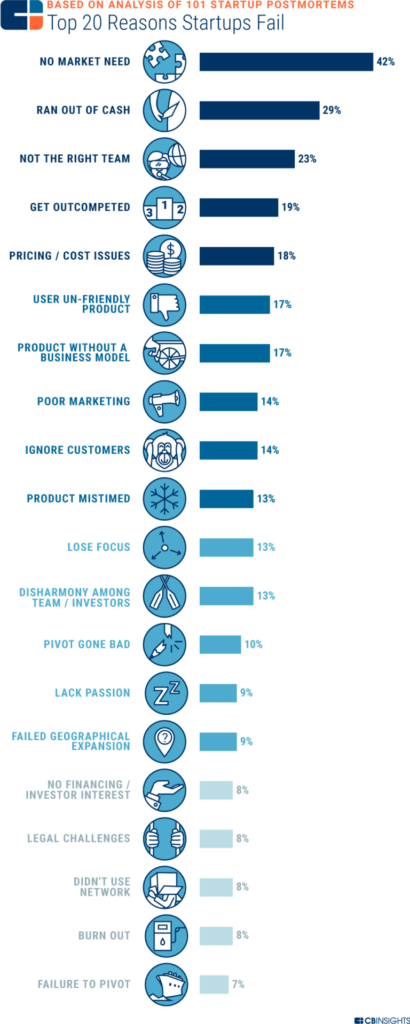

Jeff Bezos made a name for himself by writing up the 14 principles of leadership, the first of which is customer-centricity: what’s the main idea? The idea is that you start from what customers want and then work your way backwards to developing a solution meeting customer requirements. This mitigates the risk of building something useless. Applying this line of thinking to green products probably lead to useful innovations and an efficient use of capital. Today, up to 42% of VC-backed startups go bust because they fail to address a relevant market need.

Although Wall Street values short-term performance, Jeff Bezos has suggested that shareholders take on a long-term view. In his first letter to shareholders, he stated shareholders “own”, rather than rent Amazon stocks. The financial community should look for value creation in the long term, not in the short term. Applying this kind of thinking will hopefully result in building a more long-term focused economy and engineering a sustainable and durable green transition.

III/ Amazon’s operating model

Yet, one can wonder whether Amazon’s operating model is inherently unsustainable for the environment. Amazon has a reputation of encouraging urban sprawl by building numerous logistics centers in locations that would otherwise have been farmland. Plus, buying a product from Amazon ignites a sophisticated supply chain and delivery capability only to receive a limited number of products. Some have said that Amazon is probably the world leading company in distributing one or two products.Yet, when consumers want to make a week’s worth of shopping, they flock to supermarkets where they buy dozens and dozens of products in one single purchase.

In a nutshell :

- Investing ten billion dollars in a green fund is both a significant and a drop in the ocean.

- Hopefully, Jeff Bezos will introduce his thinking into the green innovation industry producing useful innovations and increasing capital efficiency.

- But at the same time, some would argue that Amazon’s operating model is inherently brown and unsustainable.

[…] article Jeff Bezos is investing $10 billion in a Green fund est apparu en premier sur The Innovation and Strategy […]