How to grow the total available market when business-to-business IT spending remains constant? How to increase revenue when so many things are changing in the business environment : clients, consumers, employees ? How can an established company like Oracle generate double-digit growth when client spending stays flats ? Where does Oracle’s find the market space to fuel additional growth? These are some of the questions that came to my mind when I met with Mark Hurd, CEO of Oracle.

I/ Introducing Mark Hurd

Mark Vincent Hurd is co-CEO of Oracle Corporation, and the past chairman, chief executive officer, and president of Hewlett-Packard. On September 6, 2010, Hurd was named co-president and member of the board of Oracle Corporation by CEO Larry Ellison. Hurd succeeded Charles Phillips and is currently working to streamline the signup and upgrade process for clients. Safra A. Catz remains the other Oracle co-president. On September 18, 2014, Ellison announced he was stepping down as CEO with Hurd and Catz becoming co-CEOs.

Mark is the author of The Value Factor: How Global Leaders Use Information for Growth and Competitive Advantage.

II/ The secret of Oracle’s performance

Oracle will become the #1 Cloud company this year :

- Projecting between 50-100% more SaaS and PaaS bookings than largest competitor in 2015

- PaaS and SaaS revenue increased by 34% and IaaS revenue rose 16% in Q1

- Plan to double our SaaS and PaaS cloud margins over the next two years

- Cloud revenue run rate is at $2.4 billion

Oracle’s Cloud strategy is working :

- Complete set of cloud capabiliHes across all layers (SaaS, PaaS, IaaS)

- Revenue growth rate is increasing; primary cloud compeHtors’ growth rates are declining

- Spent 10 years rewriHng our applicaHons and middleware for the cloud

- 9 of the top 10 cloud companies use our database in the cloud

III/ Client spending remains flat

Mark Hurd started out by mentioning that the Gross Domestic Product (GDP) of the entire world is $74.6 trillion. Of this $74.6 trillion, 3% is dedicated to IT spending which is approximately $2 trillion.

IT spending can be categorized into two different segments:

- consumer IT spending

- business IT spending

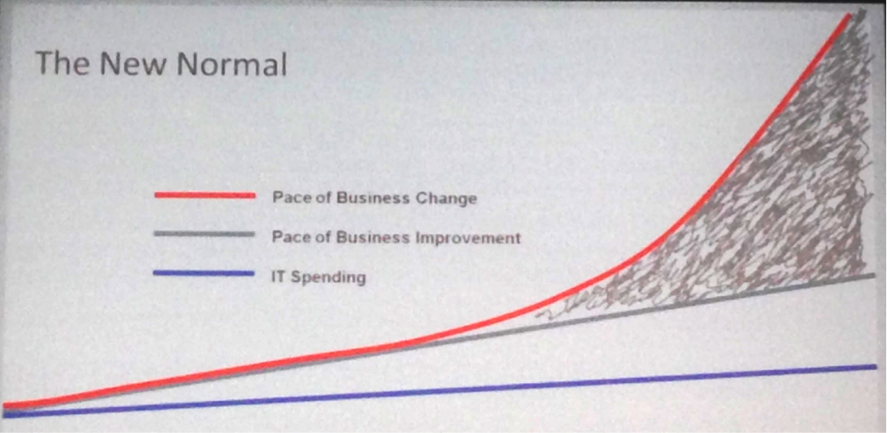

The most surprising trend affecting business IT is that, while IT spending remains constant, the pace of business change is increasing exponentially.

Plus, most companies are using 20-year-Old legacy applications that were designed before the internet, search, social technologies, mobile and cloud. These antediluvian applications are highly customized and inflexible. 80% of IT spend is dedicated to maintenance and yet the need to innovate remains ever more high. Companies must take advantage of mobile, social and real-time data analytics if they are to remain competitive.

In any case, while business IT spending is remaining constant, consumer IT spending with smartphones, social networks, increased Internet coverage and improved search capabilities growing.

IV/ Oracle’s clients are growing… slowly

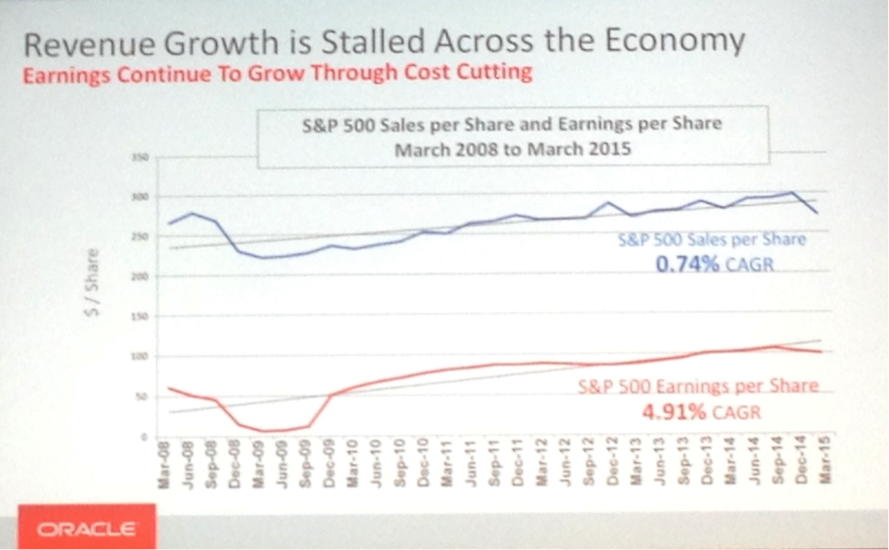

Also, if one is so look at the growth prospects of S&P Fortune 500 company, one would see that there is slow but steady growth.

Considering that Oracle is evolving in a market that seems to be constant, how does one account for the companies above industry performance? How has Mark Hurd helped the company achieve superior growth when client spending remains flat? This question becomes particularly pressing as the software giant has also had to deal with numerous changes affecting the workforce, client needs and a profound change the IT industry in itself. The question of achieving superior corporate performance remains open. It’s the subject of the next article published on FinYear.

[…] How to grow the total available market when business-to-business IT spending remains constant? How to increase revenue when so many things are changing in the business environment : clients, consumers, employees ? How can an established company like Oracle generate double-digit growth when client spending stays flats ? Where does Oracle’s find the market space to fuel additional growth? These are some of the questions that came to my mind when I met with Mark Hurd, CEO of Oracle. […]