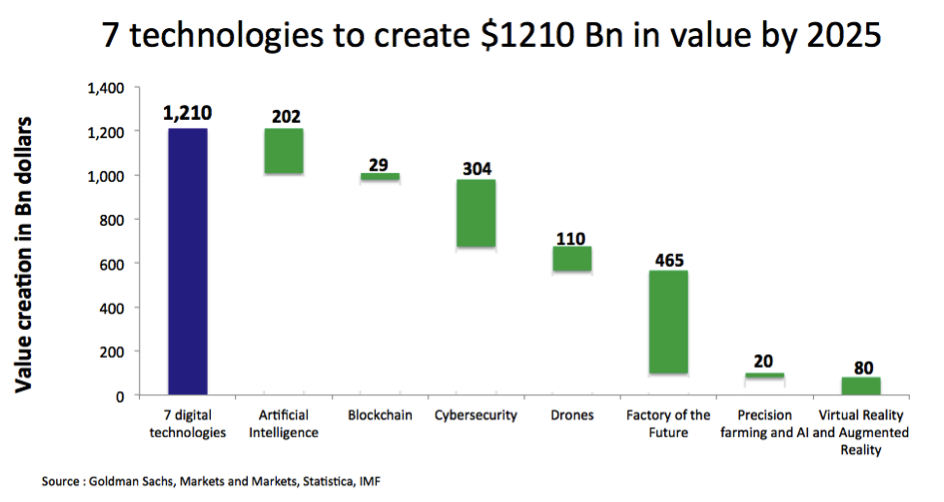

In previous articles, I indicated that digital technologies should create as much value as the Russian economy while showing, at the same time, the potential to transform every single production activity in Michael Porter’s value chain. Figuring out how value is distributed among technologies acts as a guide to setting investment priorities for multiple stakeholders:

- Shareholders may refer to a firm’s technology strategy in order to spot companies that may offer the best returns

- CEOs of established businesses identify technologies they should look for in their supplier’s product offering.

- Startup founders and tech CEOs develop an understanding of how to lift share valuation.

- CFOs and Investors know which technologies should offer superior returns.

- Innovation directors and CTOs get a sense of the technology talent pool they need to execute.

Artificial Intelligence, Blockchain, Cybersecurity, Drones, Factory of the Future, Precision and AI, Virtual Reality and Augmented Reality add to up $1210 Bn value creation opportunity

Value is unevenly distributed across the seven digital technologies. As mentioned above Smart factory stands at a promising space.

Artificial Intelligence (AI) to create $202 Billion by 2025

Artificial intelligence is sparking renewed interest with the combined development of machine learning (ML), cloud technologies making data accessible, and the Internet of Things generating large-volume data sets. ML identifies patterns addressing recurring operation issues in many companies in multiple industries. AI augmented retail optimizes pricing and enhances demand prediction. AI-enabled healthcare boosts R&D productivity during the drug development phase (Phase 1, Phase 2a and 2b). Use cases abound in the financial sector where Artificial intelligence enabled credit analysis spots risky client accounts.

Bockchain to generate $29 billion by 2025

One can be quite surprised by Goldman Sachs’s $29 billion valuation, a low figure considering that since June 2014, the 10 largest US banks by assets have participated in nine rounds totaling $267 million in disclosed funding to six blockchain companies, according to a CB Insights report.

Blockchain technologies authenticate transactions and ownership. Most applications occur in the financial and insurance industry: Cash securities, anti-money laundering compliance, real estate title insurance.

Tourism offers promising prospects as well. AirBnB recently acquired a blockchain enabled startup which uses Blockchain to certify the identity of the renter and the householder. The result: greater transparency and trust.

Cybersecurity turns out as a $304 billion by 2025

Cybersecurity covers a wide spectrum of applications ranging from the financial industry, retail, government, defense and many more. Consumer data is becoming more accessible. Breaches, however, might entail disastrous consequences especially in healthcare, finance. In Defense, it carries military implications at a time when terrorism is moving on to the internet. Failing at cybersecurity comes with financial and life-threatening consequences for users and may terminate a CEO’s job.

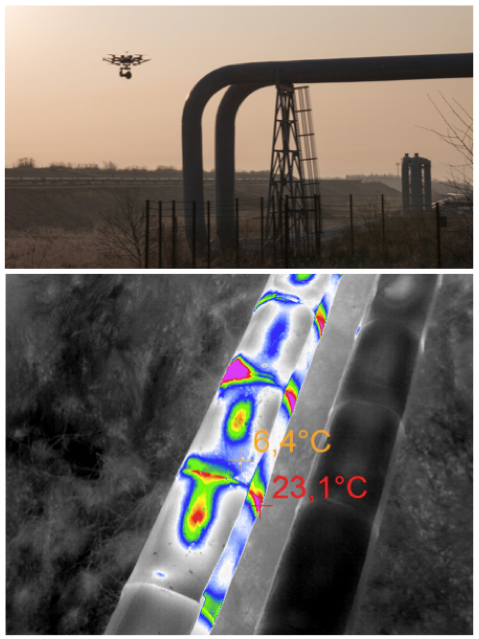

Drones to unlock a $110 billion market by 2025

Applications abound in tourism, military, entertainment liberal arts, defense and engineering. Drones serve as an airborne human eye, collecting images from sites out-of-reach to full-fleshed operators. For example, in the oil industry, drones are used to perform both refinery inspections and pipeline examinations as Michael Offredi, digital ecosystem and innovation officer at Total, once told me during an interview for Fujitsu’s energy survey published on The Innovation and Strategy Blog.

Factory of the future technologies to create $465 billion dollars by 2025

Factory of the future technologies combines the Cloud and the Internet of Things, in order to bring greater efficiency across the production chain. In this segment, many value streams already exist. For example, Goldman Sachs believes that enterprise resource planning (ERP) software, ported to the cloud, stands as a component of smart factory.

Cobots, mobots and digital twins make up part of the new revenue generation opportunity. Novel collaborative robots, known as cobots, working hand-in-hand with human operators along the assembly line, don’t pose any security risks and function without a dedicated safety net. They execute human taught production activities.

Mobile robots, known as “Mobots”, bring greater efficiency in inventory management. Amazon introduced them in their warehouses several years ago.

Digital twins mean to clone an existing physical industrial asset in digital form, allowing stress tests before any major changes are implemented in the established processes. This reduces downtime and improves overall output quality.

Precision farming to generate $20 billion dollars in value creation

Applications include precision fertilizing, precision planting, precision spraying, precision irrigation and moisture sensing.

Virtual Reality (VR) and Augmented Reality (AR) to generate $80 billion dollars by 2025

Finally, virtual and augmented reality should generate up to $80 billion by 2025 due to two significant segments. The first one, accounting for $45 billion in value creation, includes VR and AR gear. The second is made of nine use cases in retail (VR Shoping), video games, education (VR classrooms and VR content to visualize content) in addition to military applications of combat simulations.

In another article, I’ll mention in more detail some use cases offering promising growth potential. Many Senior Leaders should consider pivoting their business to capture the $1210 billion at stake.

[…] shows a lack of ability to produce global giants that are leveraging contemporary technologies such as artificial intelligence, blockchain, Internet of things, virtual and augmented reality, […]

[…] Quels cas usage devraient s’avérer florissant dans les années à venir en matière d’intelligence artificielle, de cybersécurité, blockchain et de réalité augmentée ? À en croire quelques-uns des investisseurs que nous avons pu croiser, en vérité, personne […]

[…] And yet, user-generated content represents a new form of economy from which one could build a digital currency: one that is based on individuals, as such, rather than on products or services. You find the idea […]