I’ve often believed that innovation is a critical component in any competitive strategy. But, in reading The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success by William Thorndike, Brian Troxell and Phil Gigante, I was led to analyze in closer details the making of superior performance in a depressed market segment. The example of General Dynamics, a defense company that survived and eventually thrived despite the collapse of its original market at the end of the cold war, is revealing.

I/ The Post-Cold War Defense Market Collapse

Before the end of the Cold War, the defense market in the United States was often regarded as an Admiral’s club. Generals, admirals, defense contractors, all enjoy lofty lifestyles due to lavish defense spending in the United States.

But, when the Berlin wall came down, signaling the demise of the Soviet Union and a shift in focus from defense spending to other issues, the defense market faced turmoil. Within six months of the Wall’s demise, an index of the leading publicly traded defense companies had fallen 40%.

Of the many companies in the defense market space, General Dynamics appeared as the most ill-positioned.

- In 1990, the company was informed of the cancellation of its largest new aircraft program.

- In 1991, the company had $600 million in debt and negative cash flow.

- The company had revenues of $10 billion and a market capitalization of just $1 billion.

II/ CEO performance : General Dynamics’s Exceptional Results

And yet, by 1993, the company generated $5 billion in cash. In 2008, only 15 years later, the company produced unprecedented results:

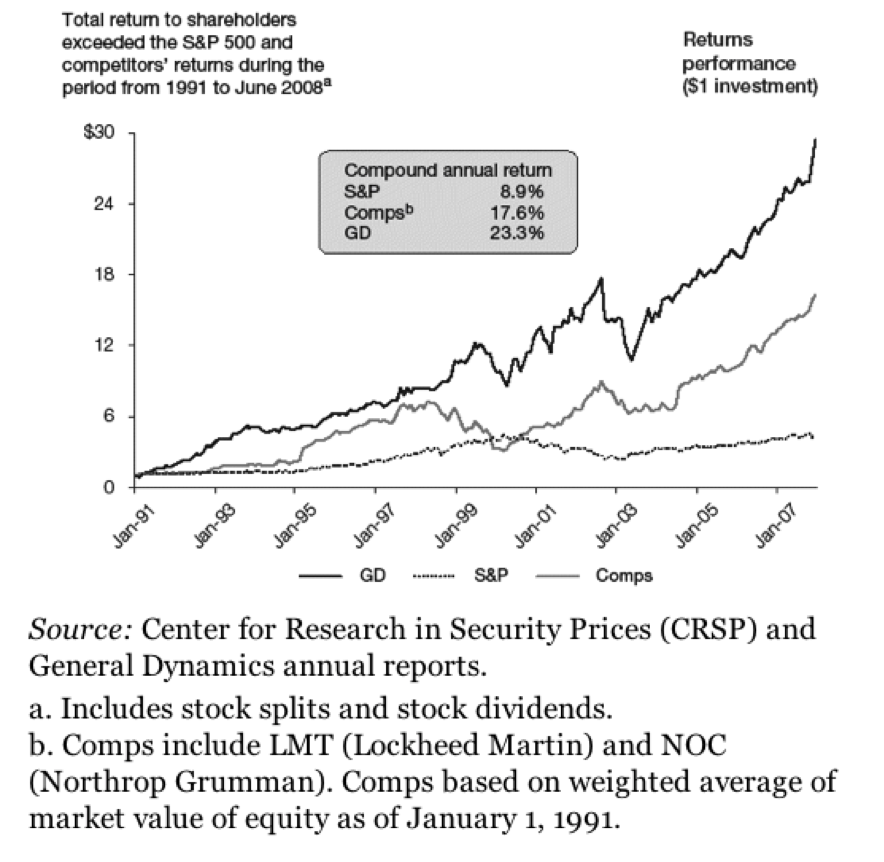

Figure 3-1: General Dynamics—a tale of three CEOs: Mr. Anders, Mr. Mellor, Mr. Chabraja

The most remarkable about General Dynamics is that, unlike any other companies that’s gone through a turn around, it has continued to grow steadily long after. In 2008, the company generated a remarkable 23.3 percent compound annual return for General Dynamics’s shareholders, compared with 8.9 percent for the S&P 500 and 17.6 percent for the company’s peers.

This corporate performance is all the more remarkable considering the fluctuating defense budget. Indeed, in the late 90s and in the early 21st century, the United States was grappling with profound geopolitical changes which had direct impacts on the Defense budget.

III/ Making Sense of Superior CEO Performance

So the question is: how did General Dynamics’s CEOs produce such superior corporate performance in a market noted for the vagaries of a fluctuating defense spending? I addressed the question in a discussion with Vernon Altman, Senior Adviser of Bain and Company and Bain’s first employee. Author of From Bad to Great, Vernon started Bain’s Full Potential Practice as a result of his experience in leading the General Dynamics transformations.

IV/ Understanding Full Potential Transformation

Full Potential Transformation involves looking at all the levers involved in superior corporate performance by looking at:

- the customers,

- the competitive position,

- the cost structure,

- the organizational structure,

- the corporate strategy and

- anything that has any impact on long-term sustainable value.

There are several things that could trigger a desire for Full Potential Transformation in a company:

- A new CEO may have been nominated; he nominates a management team. He may want to make his mark. This is a good time for a Full Potential Transformation.

- The second reason is a sustained period of underperformance. The business is not getting any better nor is it getting any worse.

- The third could be an important competitive move. A competitor may have made an important acquisition, or they may be a new entrant coming into the market that changes the share of value in the industry.

- The fourth reason is a decline in business. Vernon mentioned that when General Dynamics had to face a drop in defense spending when the Cold War came to end, “the company’s stock dropped by 75% in 1990, followed by $1 billion write-off in January 1991”. The company engaged in Full Potential Transformation.

In order to explain how General Dynamics’s CEOs achieve superior corporate performance and get better sense of what Full Potential Transformation is all about, the simplest way is to describe the key corporate decisions they made from 1990 to 2008. In these 18 years, three CEOs were at the helm of the company at different points in time: Mr. Anders, Mr. Mellor, Mr. Chabraja.

No comment